2021 Another Top Year: H1 2021 Gaming Investments and M&As are Double 2020

DDM Games Investment Review Q2 2021 Report Available

By the DDM Data & Research Team

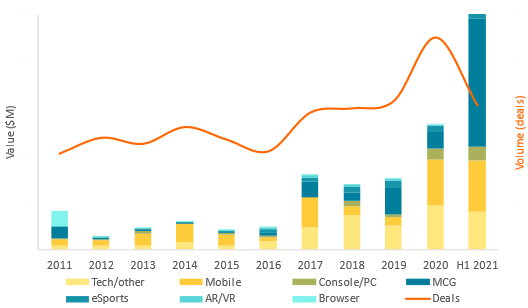

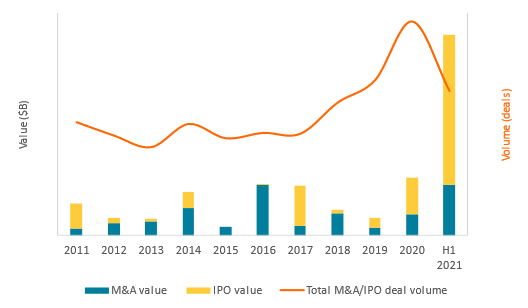

After a tremendous 2020 year and Q1 2021, this robust momentum continued in Q2 with over 200 investments and Merger & Acquisitions (M&As) deals, a total of $7.4 billion in investments and a new record $18.2 billion in acquisitions or mergers. With the first half of the year in the rearview mirror, the combined amount of investments and M&As of games companies has already doubled 2020’s record-setting year.

Investments

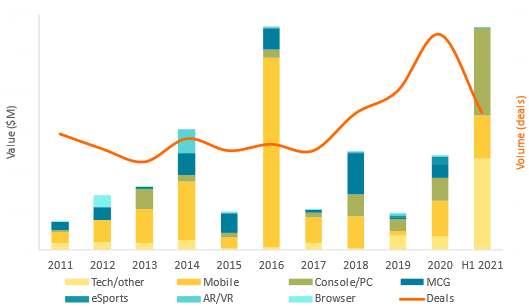

In Q2 2021, we tracked over 135 transactions worth nearly $6.7 billion in disclosed deals. While the quarter did not break records, it’s the second-highest quarter in value and volume in the past ten years. When including the transactions with undisclosed values, we estimate the total value of investments for Q2 to be $7.4 billion.

The strength of Q2 is in combination with Q1: the first half of 2021 at over $25.4 billion is $1.2 billion shy of doubling 2020’s record year in value at two-thirds the volume.

(Source: DDM Games Investment Review)

In estimating the value of undisclosed deals, we harnessed the power of our historical data to derive value averages that consider a number of key factors in order to provide a more accurate picture of all deal activity. Combining the value of disclosed deals with our undisclosed estimate, we estimate all investments for the quarter reached $7.4 billion with a margin of +/- $200 million.

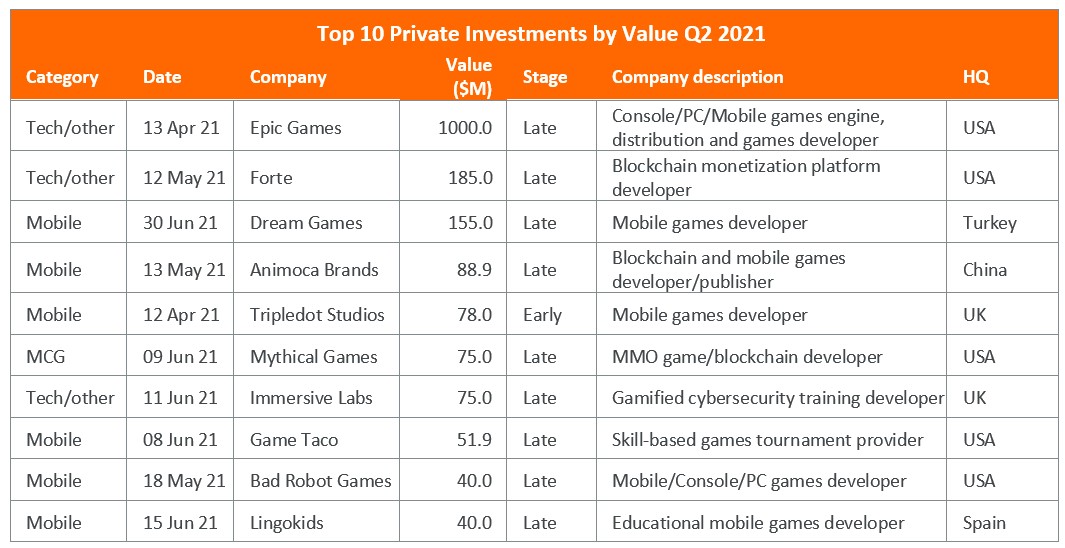

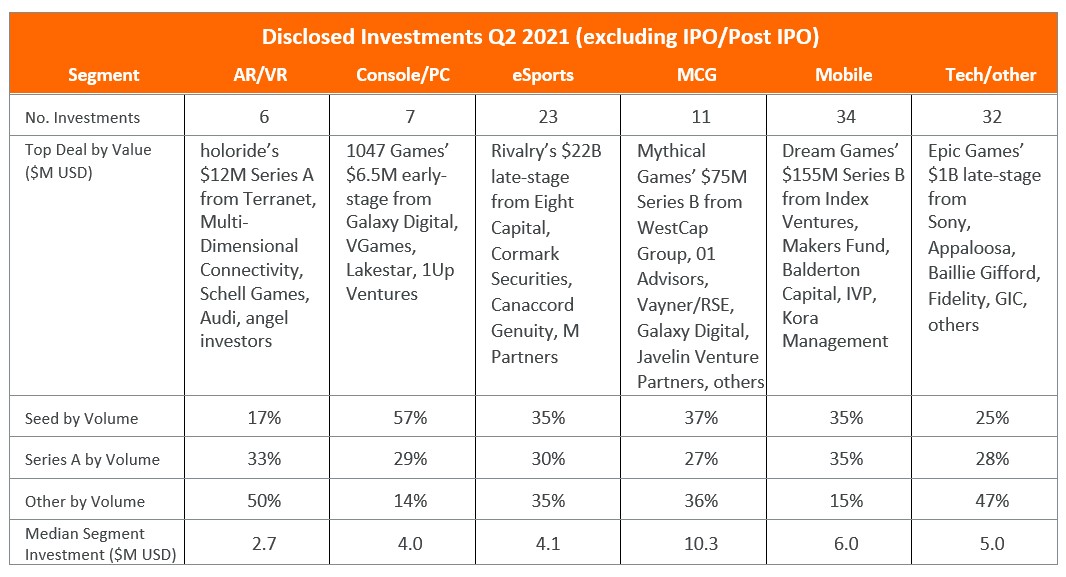

From disclosed investments, Q2’s value/volume were mainly driven by investments in Mobile (41% / 27%) and Tech/other (50% / 26%). While public companies continued to raise the majority of investments via IPO and Post IPO raises (combined 64%), Epic Games’ late-stage raise of $1.0 billion at a $28.7 billion valuation was 15% of Q2’s investments. Series B raises contributed another 10% of the quarter’s value, topped by Dream Games’ $155 million and Forte’s $185 million.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

As we have seen in the past, late-stage investments in gaming Tech such as Epic Games’ $1.0 billion dominate. Interest in Turkish development studios continues as with this quarter’s Dream Games. We saw an increase in the number of blockchain gaming-related transactions during this quarter, with three breaking into the top investments list: Forte, Animoca Brands and Mythical Games.

Among the funding stages such as Accelerator, Pre-Seed, Seed, and Series A to later-stage funding rounds like Series H, Seed funding was the most common with a volume of 43 transactions. Series A was the next common funding stage with 36 transactions. The early-stage investments of Pre-Seed to Series A totaled over $464 million and 7% of the quarter across more than 90 transactions.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

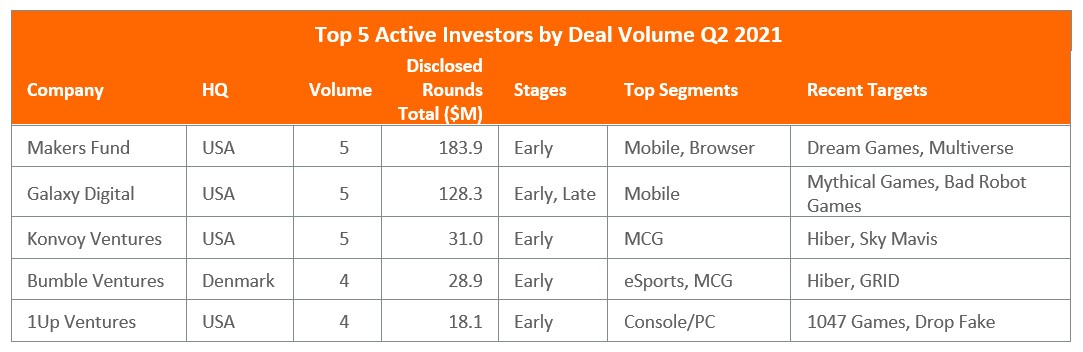

Under active investors for the quarter, we list the most active firms by deal volume as well as the total value of the disclosed rounds in which they participated. As always, our investment tracking primarily focuses on deals that happen in the West and do not typically list the contribution breakdown by firm since they’re rarely announced. Q2’s active investor list was dominated by gaming-centric investment firms: Makers Fund, Konvoy Ventures, and 1Up Ventures. Galaxy Digital, which focuses on crypto, participated in Mythical Games’ $75.0 million Series B while Bumble Ventures focused on the Nordic countries’ strong gaming industry.

(Source: DDM Games Investment Review)

M&As

We tracked nearly 70 mergers and acquisitions at 87% of the volume of the previous quarter. Q2’s disclosed values for M&As totaled over $18.2 billion, 178% of Q1 and the highest quarter in our historical data going back over ten years. Combined, the first half of 2021 at $28.5 billion is more than double 2020’s full annual total of $11.9 billion. By value, Tech/other (64%) and Mobile (25%) were the highest segments. By volume, Console/PC (32%) and Mobile (24%) were the most active.

(Source: DDM Games Investment Review)

As with Q1, over half of the tracked M&As for the quarter were acquisitions of game developers and publishers. As the volume of investments in Console/PC companies were one-third the previous quarter, acquisitions of Console/PC companies continued at a robust quarterly volume at 87% the volume of Q1.

The top transactions – ironSource and PLAYSTUIOS’ reverse mergers, Electronic Arts’ acquisition of Glu Mobile, and Embracer Group’s acquisition of Gearbox Software – totaled nearly $15.7 billion and were 86% of all disclosed M&As for the quarter. ironSource’s debut on the New York Stock Exchange alone was 60% of the quarter’s disclosed values.

(Source: DDM Games Investment Review)

Because M&As have fewer disclosed details, ranking active acquirers is challenging. Based on volume, active acquirers were led by Embracer Group with 7 acquisitions and Facebook with 3 purchases. Other acquirers with more than one transaction include Electronic Arts, Enthusiast Gaming, Esports Entertainment Group, and Stillfront Group.

Exits

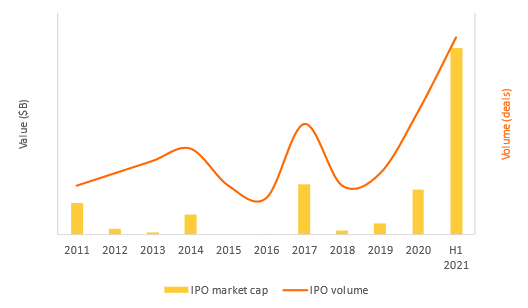

Four companies went public via IPO in Q2 raising over $2.0 billion, further extending the record-setting value and volume pace started in Q1. The total market capitalization for these companies was nearly $28.6 billion, the second highest quarter after Q1’s record, mostly driven by AppLovin’s debut on the Nasdaq exchange.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

In addition to ironSource and PLAYSTUDIOS, gaming rewards and blockchain service provider 1Wondr Gaming Corporation also debuted on Canadian Securities Exchange via reverse merger, bringing the total of gaming companies going public to 7 for the quarter.

Q1 2021’s exit value was more than double all of 2020’s record $32.5 billion. Combined with Q2’s $46.9 billion, the exit value of M&As and public debuts for H1 2021 reached a record $112.9 billion, nearly exceeding the total combined exit values from the previous five years (2016-2020), $113.8 billion. This high value was reached while tracking two-thirds the volume of transactions in 2020.

(Source: DDM Games Investment Review)

New Funds

In Q2, new funds were announced or reinjected with funding that either targeted gaming specifically or raised by firms with a previous history of games investments, including:

- Roblox investor Tiger Global Management – in process to raise $10 billion for minority investments in technology start-ups

- Crypto and metaverse investor Andreessen Horowitz – announced $2.2 billion Crypto Fund III for blockchain investments

- Early-stage eSports and gaming investor Golden Ventures – raised $100 million fund and a smaller $20 million fund for follow-on investments focused on Canada and US companies

- The Games Fund – increased its target fund raise from $30 million to $50 million for early-stage companies in the US and Europe

While past the half-year mark, we expect the second half to continue with robust activity. PUBG’s parent company Krafton’s $5 billion IPO in South Korea is targeted for Q3. Electronic Arts is to complete its $1.4 billion acquisition of Playdemic while publishers Devolver Digital and Jam City will also have public debuts in Q4.

—

The DDM Games Investment Review Q2 2021 report is now available for purchase: $399 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.