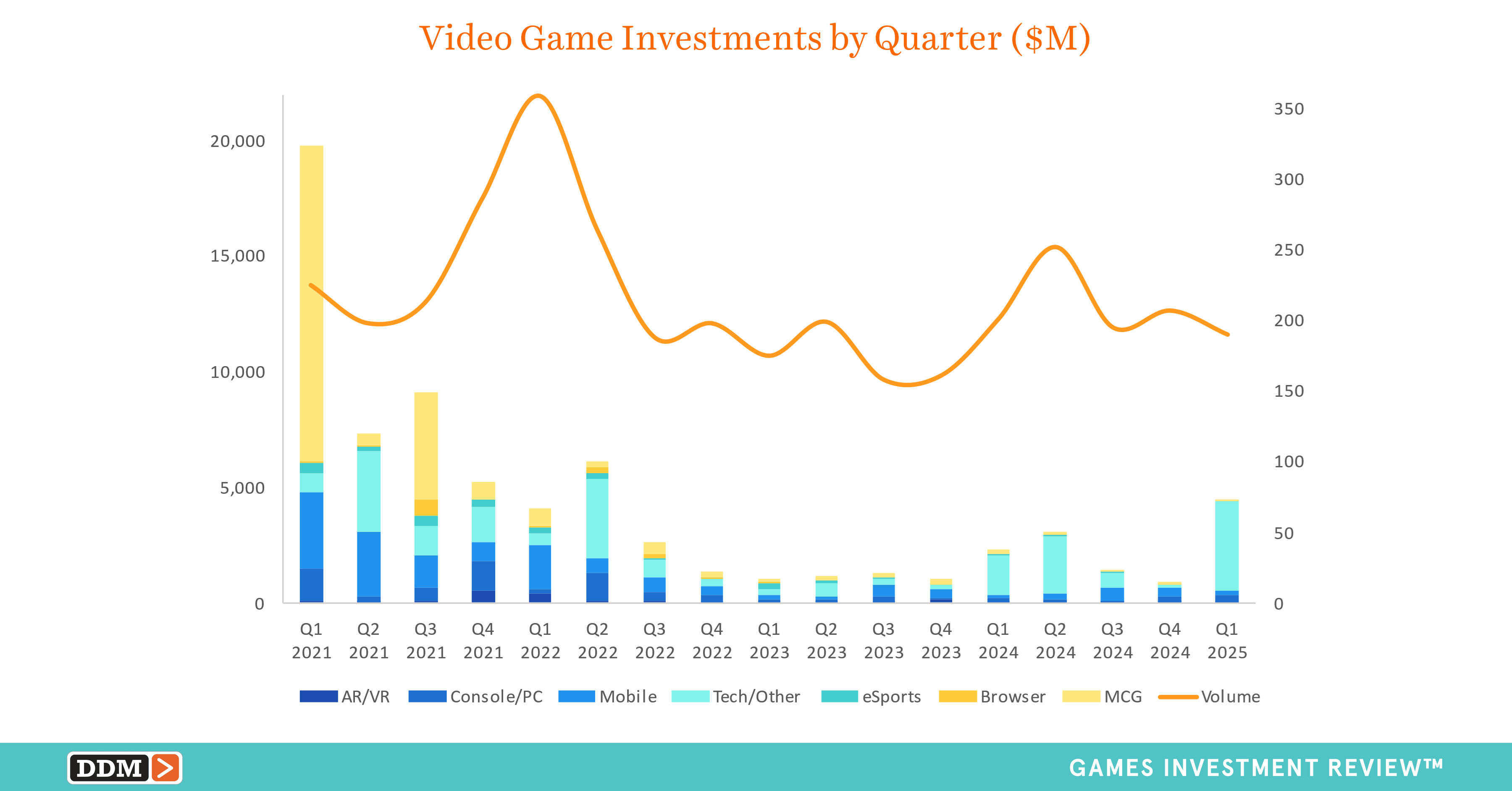

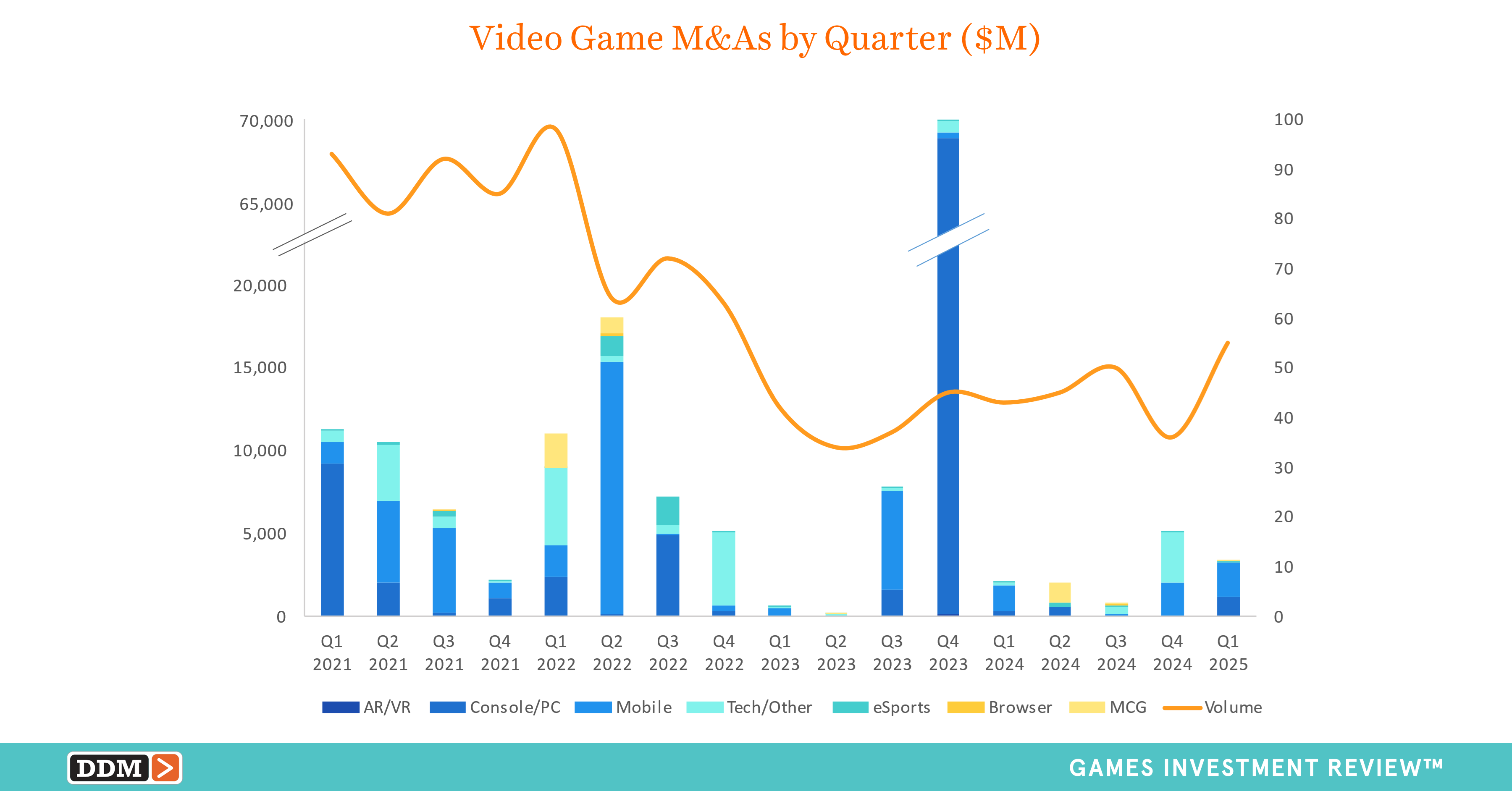

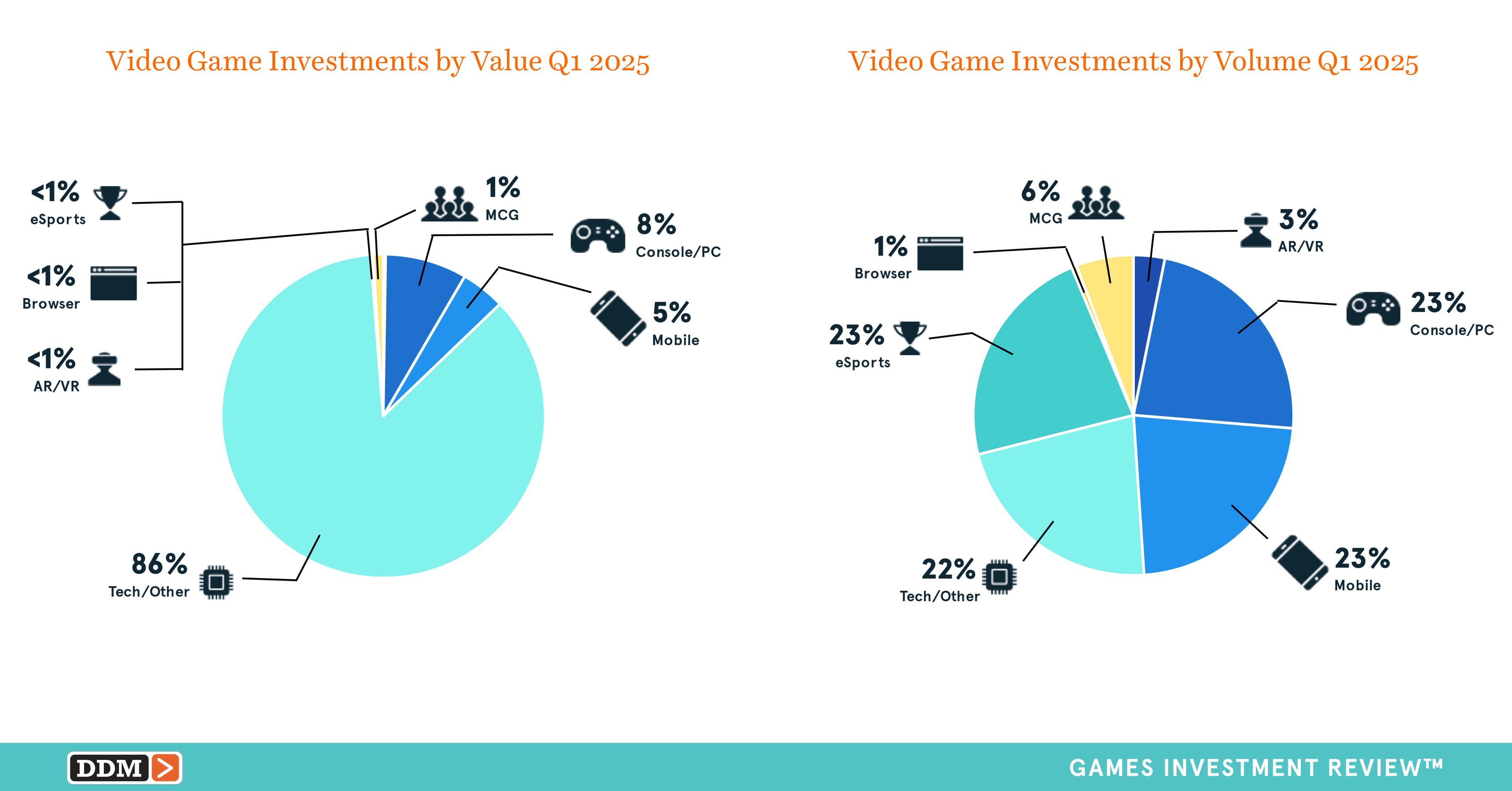

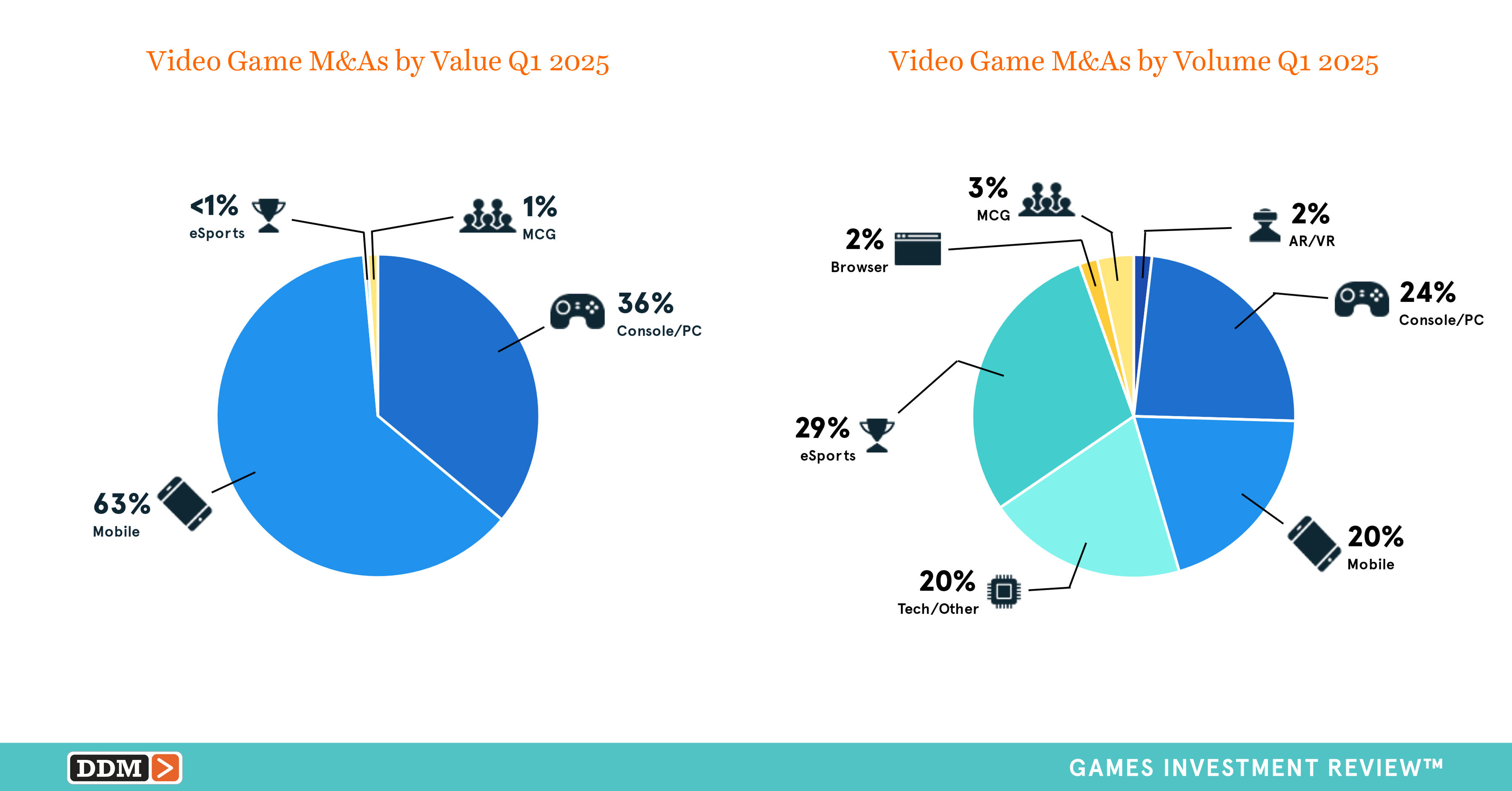

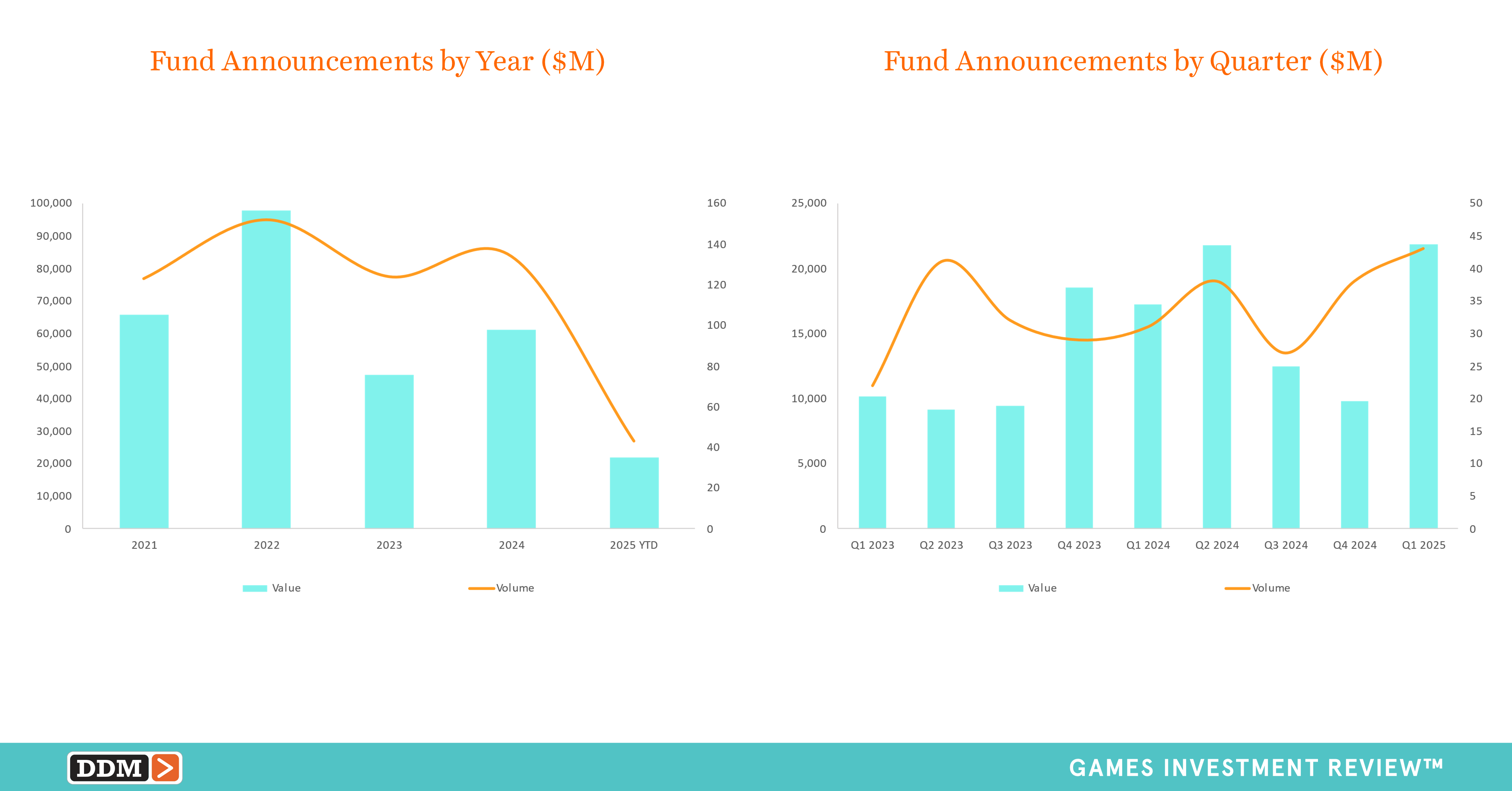

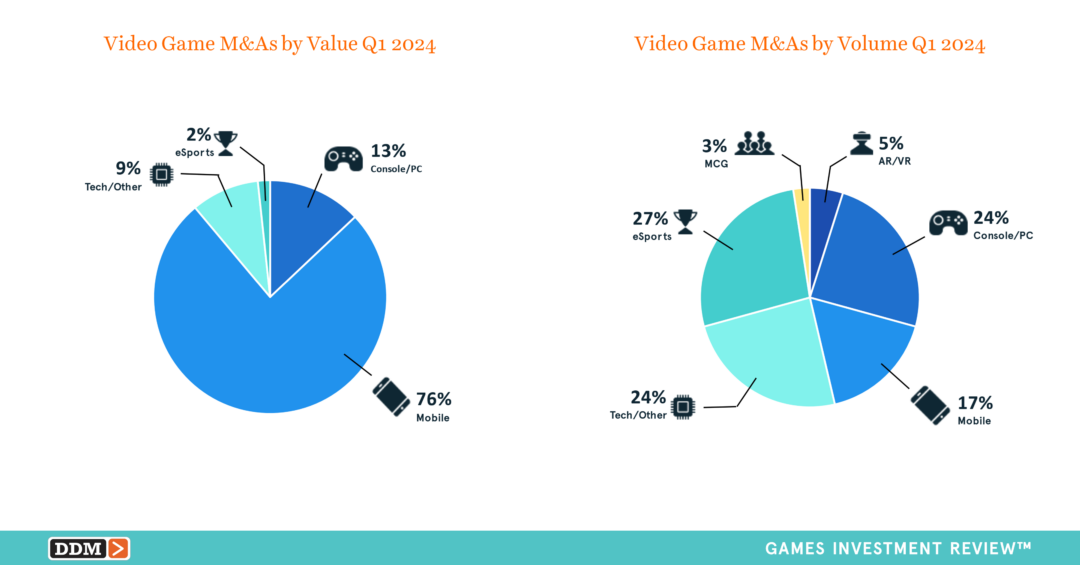

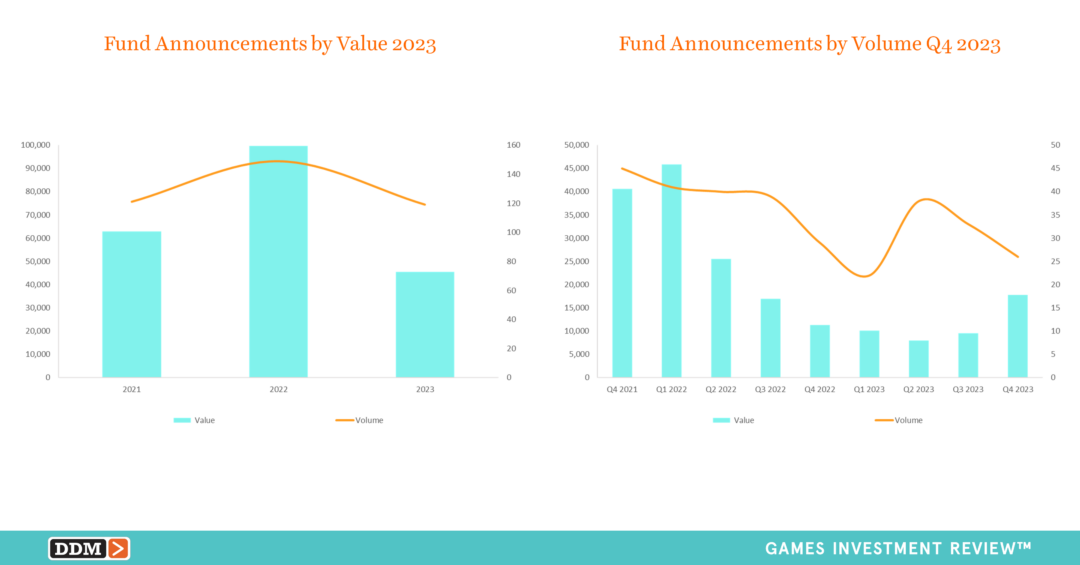

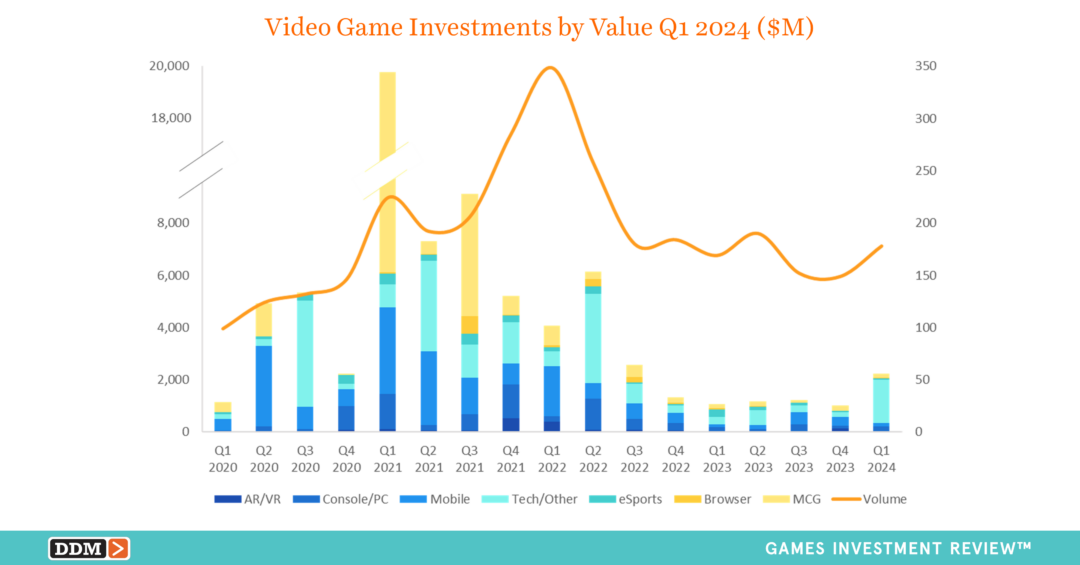

Investment and M&A

The DDM GIR is the industry’s longest-running dataset, covering over sixteen years of meticulously tracked video game industry investment and M&A data updated daily. Data points include industry sector, region, investment round, investors and acquirers and many other demographic criteria.