Q1 2021’S $18.7 Billion in Investments and $10.5 Billion in M&AS Rival 2020

DDM Games Investment Review Q1 2021 Report Available

By the DDM Data & Research Team

After such a blockbuster 2020, we have been curious to see how the momentum carries over in 2021. As a quick recap, 2020 was the most active year we have on record since 2006 with over 600 deals, a record $13.2 billion in investments, $11.3 billion in mergers and acquisitions (M&As), and the exit value of M&As and IPOs for 2020 reaching a record $31.8 billion. As we will explore, 2021 is off to a record-breaking start, rivaling totals achieved in 2020.

Investments

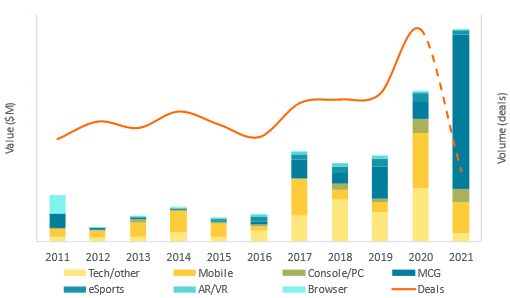

In Q1 2021, we tracked nearly 140 transactions, a +75% volume increase over Q1 2020, totaling over $18.7 billion. This means Q1 alone broke last year’s annual record! This quarter’s value was mainly driven by companies going public, comprising over 82% of the quarter’s total value. In fact, Roblox’s public debut via Direct Public Offering (DPO) on March 10th raised $12.8 billion, nearly matching 2020’s annual total of $13.2 billion. Roblox’s DPO followed a $520 million Series H round announced in January 2021, which was 2.8% of the quarter’s value. Combining Series H and its DPO, Roblox accounts for over 71% of the quarter’s total value. Without Roblox’s DPO, the value for the quarter would be $5.9 billion, an outstanding number on its own given the average value of investments for a first quarter in a calendar year from 2010 to 2020 is $809 million, with the previous high reaching $2.3 billion in Q1 2019.

Games Investments

(Source: DDM Games Investment Review)

In reviewing the total value of investments by industry segment, Mass Community Games (MCGs that include MMO/MOBA/battle royale games) driven by Roblox represent the highest total of investments at 73%, followed by Mobile (14%) and then Console/PC (6%). In terms of volume or number of deals, Mobile (29%) was the most active, followed by eSports (24%) and Console/PC (21%).

Other outstanding investments for the quarter include post IPO raises from Embracer Group ($890 million), MTG ($127 million), and Nacon ($106 million). We expect these will continue to fuel further consolidation. Dapper Labs rode a heightened interest in blockchain technology and raised $305 million in a late-stage round.

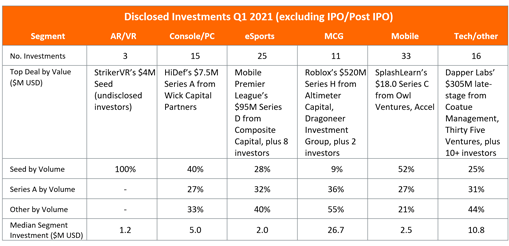

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

Among the funding stages, such as Accelerator, Pre-Seed, Seed, and Series A to later-stage funding rounds like Series H, Seed funding was the most common with a volume of 38 transactions. Series A was the next common funding stage with 31 transactions. The early-stage investments of Pre-Seed to Series A totaled over $383 million and 2% of the quarter across more than 70 transactions.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

If we remove Roblox’s Series H, the median investment for the MCG segment is $15.8 million.

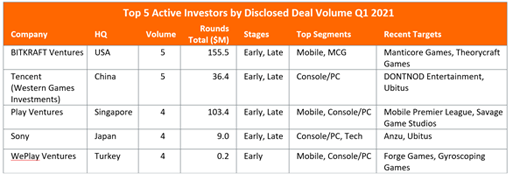

We continue to see high activity from familiar names under active investors for the quarter: BITKRAFT Ventures, Tencent, and Play Ventures. We list the most active firms by deal volume as well as the total value of the disclosed investments in which they participated as disclosed. As always, our investment tracking primarily focuses on deals in the West and does not typically list the contribution breakdown by firm since they are rarely announced.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

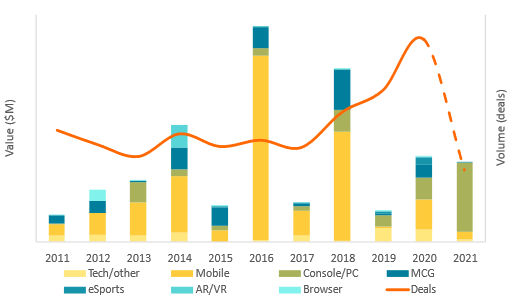

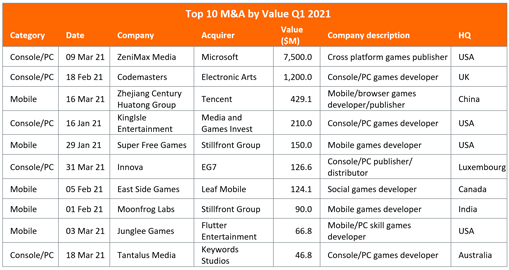

M&As

In Q1 2021, we tracked over 75 mergers and acquisitions (M&As), nearly double Q1 2020’s transaction volume. Q1’s disclosed values for M&As totaled over $10.5 billion, which almost rivals 2020’s annual total of $11.3 billion! By value, Console/PC (87%) and Mobile (9%) were the highest segments. By volume, Console/PC (32%) and Tech/other (28%) were the most active.

Game developer and publisher acquisitions comprised over half of the tracked M&As for the quarter. This quarter’s total value was mainly driven by Microsoft’s acquisition of Bethesda’s parent company ZeniMax Media for $7.5 billion, 71% of the quarter. As an outlier, if Microsoft/ZeniMax is removed, the quarter would have totaled $3 billion, which is more in line with the average value of M&As for a first quarter in a calendar year from 2010 to 2020 at $3.3 billion.

Games M&A

(Source: DDM Games Investment Review)

Electronic Arts also completed its acquisition of Codemasters for $1.2 billion this quarter, further consolidating its dominance in racing games. Combining Microsoft/ZeniMax and Electronic Arts/Codemasters, these transactions accounted for nearly 83% of Q1’s value of M&As.

The total value of disclosed acquisitions continues to be dominated by publicly traded corporations, including some transactions that were large secondary sale shares of current investors selling or reducing a portion of their holdings, which we excluded in our Top 10 table below.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

After a burst of activity in 2020, this quarter was quieter on the Embracer Group front, which completed its acquisition of Zen Studios. However, as noted under Investments, the company raised $890 million in this quarter, with its CEO Lars Wingefors commenting that the raise “enables us to continue our strategy in welcoming more new great companies to the group” in their press announcement.

In general, M&As have fewer disclosed details which makes ranking active acquirers challenging. Active acquirers with more than one M&A in the quarter include Epic Games, Jumpgate (formerly Three Gates), Motorsport Games, Stillfront Group, Take-Two Interactive, Tencent, tinyBuild, and VSPN.

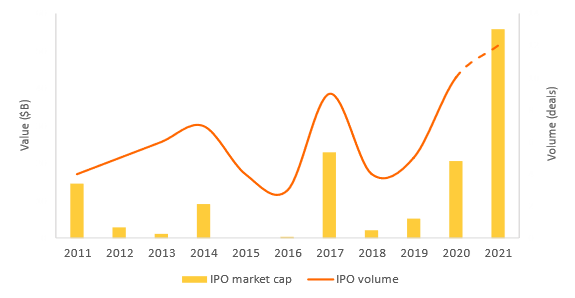

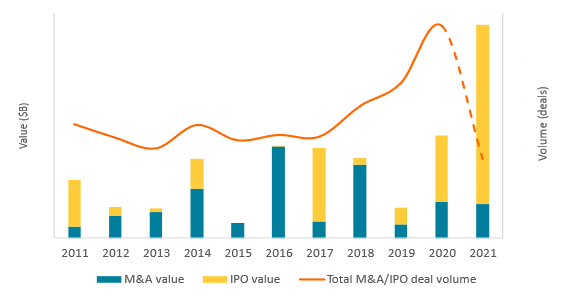

Exits

Twelve companies went public in Q1, raising $15.4 billion and surpassing 2020’s record volume. The total market capitalization for the quarter was nearly $55.8 billion, more than double all of 2020’s $20.6 billion. This quarter alone has broken the preceding ten-year trend of a breakout year followed by two slower years.

Games IPOs

(Source: DDM Games Investment Review)

In addition to Roblox’s $12.8 billion DPO, which achieved a $42.1 billion market capitalization, the next highest debuts were mobile game publishers Playtika and Huuuge Games, raising $1.9 billion and $447 million, respectively.

(Source: DDM Games Investment Review)

Adding the value of acquisitions and market capitalizations, the exit value of M&As and public debuts for Q1 2021 at $66.3 billion was more than double all of 2020’s record total of $31.8 billion. Roblox’s DPO was the majority of the value and market capitalization for the quarter at 83% of the quarter’s raise and 75% of the total market capitalization.

Games Exits (M&As + IPOs)

(Source: DDM Games Investment Review)

New Funds

In Q1 2021, several new funds were announced or reinjected with funding that either targeted gaming specifically or raised by firms with a previous history of games investments, including:

- BVP XI, BVP Century II funds from Bessemer Venture Partners – $3.3 billion for early- and growth-stage enterprise and consumer technologies

- Debut fund from Night Media – raising $20 million to invest in gaming startups that focus on user-generated content

- Black Developers Initiative from Niantic – prototype funding for mobile location-based AR projects led by majority-Black teams

- Venture Reality Fund II from The Venture Reality Fund – raising $50 million for XR projects

Other Notable Transactions

Some headlines were generated this past quarter by announced deals that have yet to be completed, such as Electronic Art’s acquisition of mobile developer/publisher Glu Mobile. As of this writing, PUBG’s parent company has applied for an IPO in South Korea.

While the DDM Games Investment Review tracks strictly game investment and M&As, there were transactions among entertainment and technology-related companies that made headlines on various gaming sites, including:

- Cloud computing service provider Incredibuild’s $140 million Series A

- Mobile advertising service provider Digital Turbine to acquire mobile advertising/monetization provider AdColony’s for $400 million

- Private investment company Silver Rain’s original IP funding deal with Electronic Arts

- Element Partners’ acquisition of the World Poker Tour from Allied Esports

- Business-to-business AR solutions provider Blippar’s $5 million early-stage round from Chroma Ventures, West Coast Capital, and Candy Ventures

- Indian fantasy sports betting developer Dream Sports’ $400 million secondary share sale among TCV, D1 Capital Partners, and Falcon Edge

As shown in this quarter, two companies, Roblox and Microsoft, had an outsized impact on values for investments and M&As. However, apart from their particular transactions, the landscape for investing in gaming companies continues to be robust. Additionally, with new funds announced and continued high corporate revenues, there is additional capital to continue a healthy momentum of games investments throughout the year.

—

The DDM Games Investment Review Q1 2021 report is now available for purchase: $399 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.