Q2’s $784.4M Investments/M&As Marks Full-Year Decline

H1 2023 is the weakest since 2016 while 2023 could bounce back with record-breaking H2

By the DDM Data & Research Team

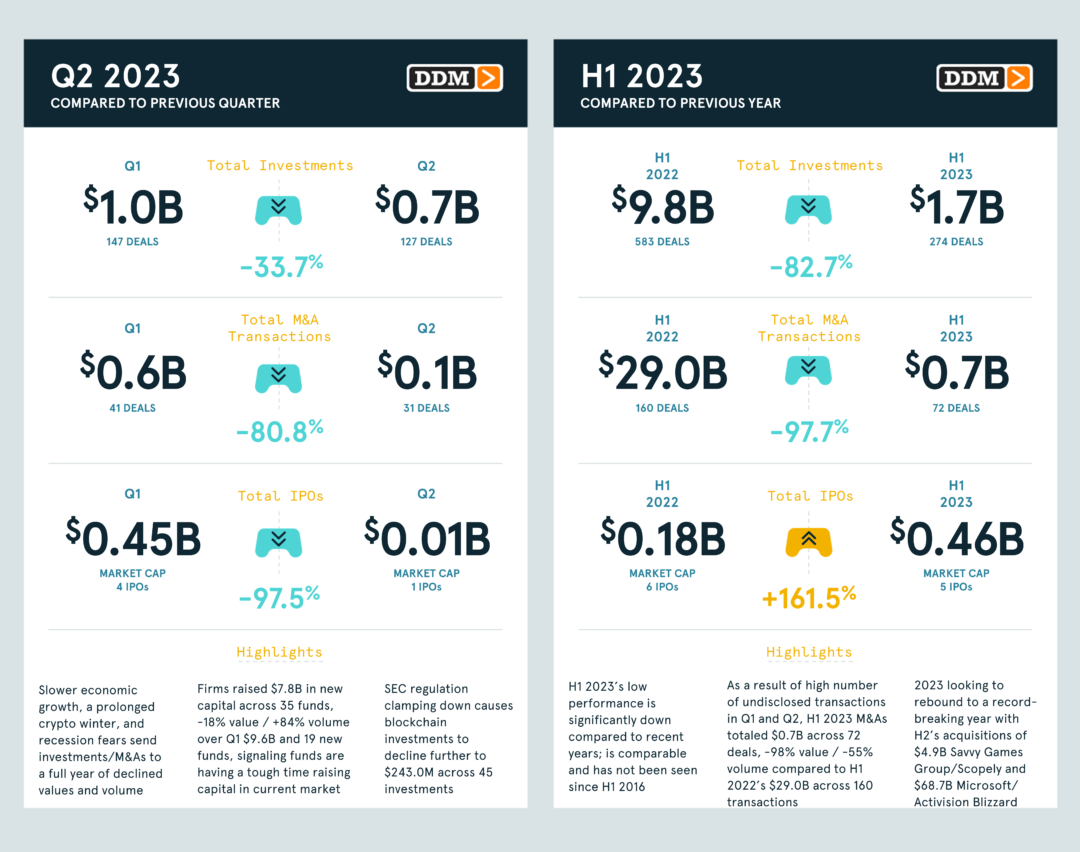

Over the last year, the games industry withstood macroeconomic headwinds of high inflation and recession fears, a prolonged crypto winter, bank failures, and slower global economic growth. As a result, games investments and M&As in Q2 2023 have marked four quarters or a full year of decline in value and volume.

With a low total not seen since 2016, H1 2023 investments totaled $1.7B across 274 investments, -83% in value and -53% in volume over H1 2022’s $9.8B over 583 investments. H1 2023 M&As totaled $673.4M across 72 transactions, -98% in value and -55% in volume compared to H1 2022’s $29.0B across 160 transactions.

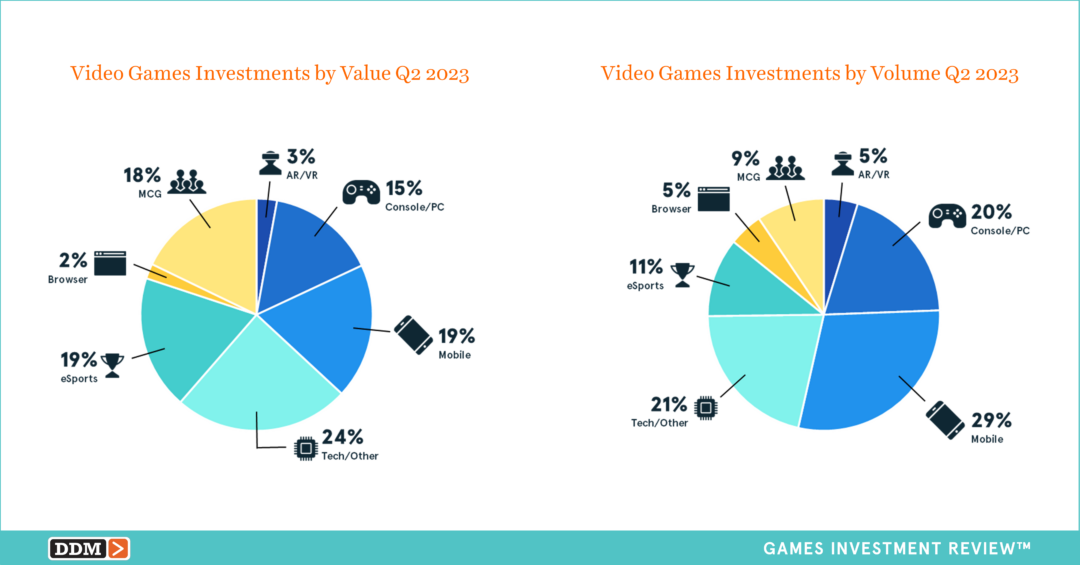

For investments, Q2 2023 totaled $676.0M across 127 investments, -34% in value and -14% in volume compared to Q1’s $1.0B across 147 investments. Highest segment by value and volume:

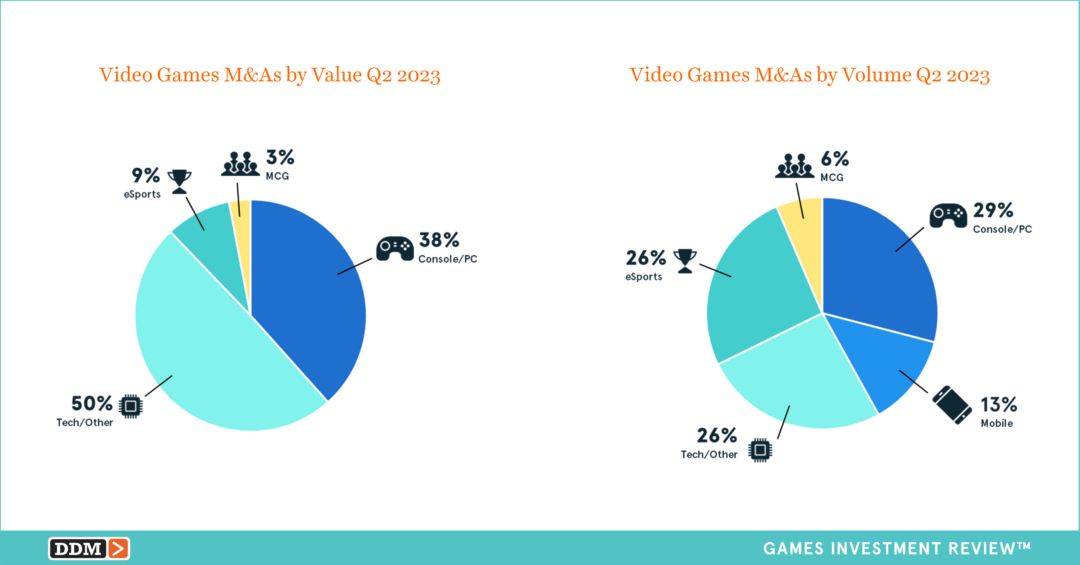

For M&As, Q2 2023 reached $108.4M across 31 transactions, -81% in value and -24% in volume compared to Q1’s $565.0M across 41 transactions. Highest segment by value and volume:

Over $7.8B in new capital raised across 35 new funds, -18% in value and +84% in volume compared to Q1 $9.6B across 19 new funds, suggesting that venture capital firms are having a hard time raising capital given market conditions, but are still trying to make investments at a bargain.

Despite the decline in games investments and M&As, H2 could rally to a record-breaking year after Savvy Games Group’s $4.9B Scopely acquisition closed in July (Q3) and as Microsoft’s $68.7B acquisition of Activision Blizzard is closer to regulatory approval and looking likely to close in Q3.

In our report, we also highlight big stories that impact the industry, including:

• Microsoft Steps Closer to Acquiring Activision Blizzard

• Blockchain Slammed by Regulations Making Blockchain Game Investors Flee

• AI in Games: The New Wave with Legal Complications

• Embracer Group’s Halt in Acquisitions Sends Ripples Throughout Industry

Read more in our Q2 2023 Games Investment Review Free Summary or purchase the standalone single report for $399. Additional data charts and tables from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com.

Our extensive analyses, insights, and expertise continues be recognized by Forbes, Deadline Hollywood, and GamesIndustry.biz. To read our latest Q2 report showcasing how Q2’s $784.4M investments/M&As marked a full-year decline, click here. We recently updated our reports with more data and visualizations and hope you enjoy the free and paid reports. We always welcome your feedback at data@ddmagents.com.