Q1’s $4.3B Over 219 Investments/M&As Marks a Positive Start to 2024

Excluding Microsoft’s $68.7B acquisition of Activision Blizzard in Q4 as an outlier, Q1 2024’s $4.3B across 219 investments and M&As nearly doubles Q4 2023’s $2.3B in value

By the DDM Data and Research Team

Despite game industry layoffs and business turmoil, investments and M&As show a return to cautious growth. When comparing Q1 2024 to Q4 2023, Q1 2024 is a significant decline (-94% in value and +13% in volume compared to Q4’s $70.1B across 194 transactions) but excluding Microsoft’s $68.7B acquisition of Activision Blizzard in Q4 as an outlier, Q1 2024’s $4.3B across 219 investments and M&As nearly doubles Q4 2023’s $2.3B in value, indicating a positive start to 2024.

Investments

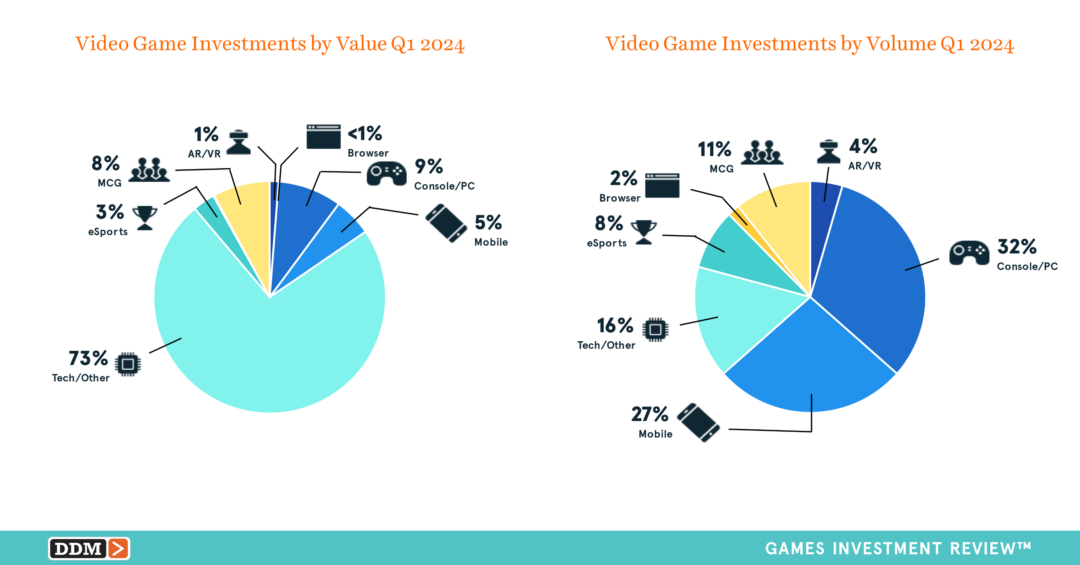

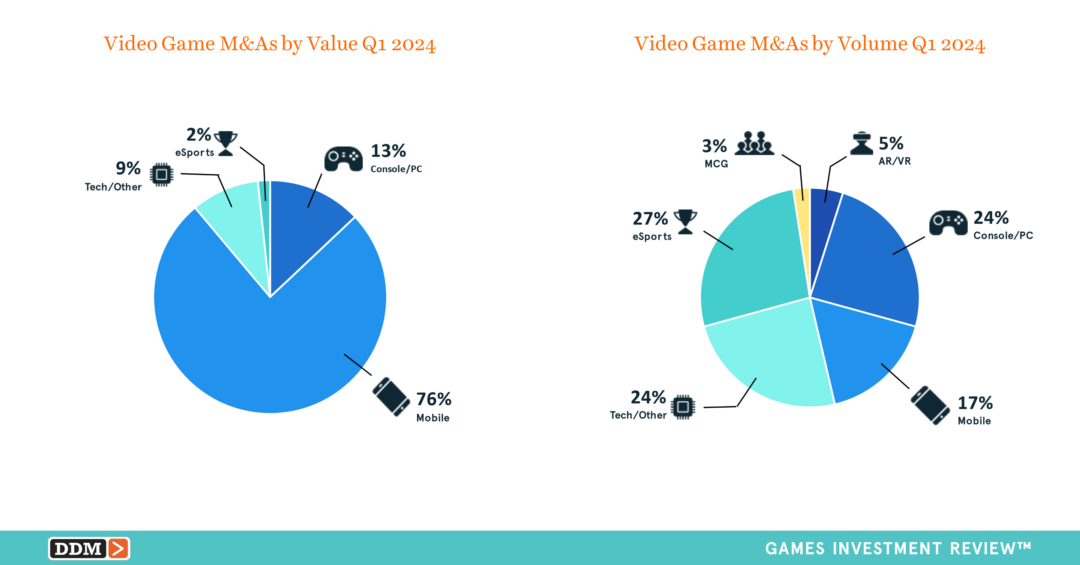

Q1 2024 investments totaled $2.2B across 178 investments (+123% in value and +20% in volume compared to Q4’s $1.0B and 149 investments) and is the first quarter to achieve over $2.0B in investments since Q3 2022’s $2.6B and 180 investments. Highest segment by value and volume:

M&As

Q1 2024 M&As totaled $2.0B across 41 transactions (-97% in value and -9% in volume over Q4’s $70.0B across 45 transactions), a significant decrease due to Microsoft’s $68.7B acquisition of Activision Blizzard in Q4 2023. As Microsoft’s acquisition is an anomaly and to compare quarters more accurately, without Microsoft/Activision Blizzard, Q1 2024 was +65% in value and -7% in volume compared to Q4 2023’s $1.2B across 44 transactions. Highest segment by value and volume:

New Fund Announcements

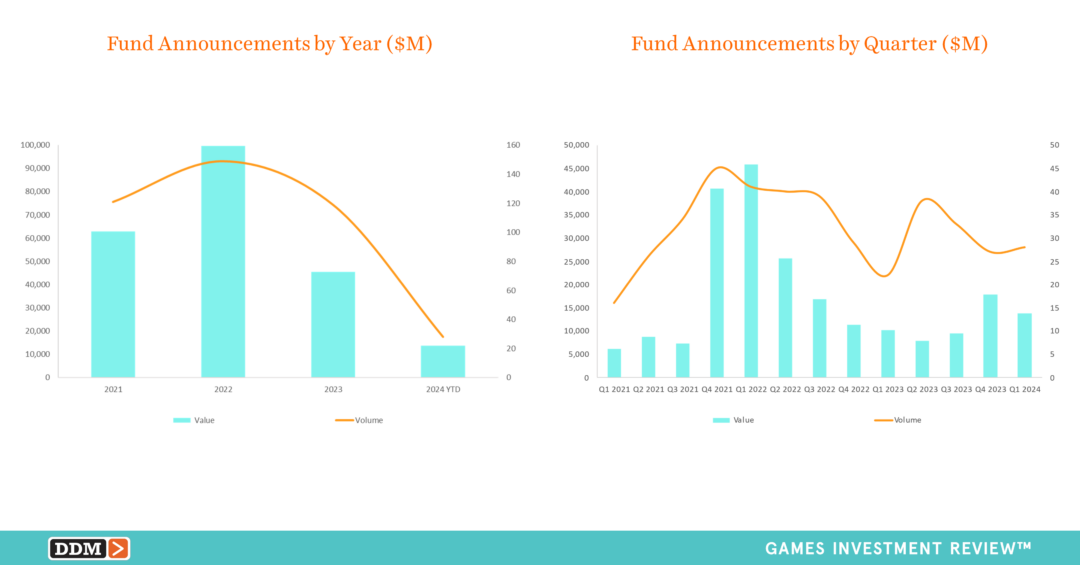

Q1 2024 new fund announcements totaled $13.7B across 28 funds (-23% in value and +4% in volume compared to Q4 2023’s $17.8B across 27 funds). As mentioned in prior reports, fund managers continue to struggle on raising capital from LPs as Q1 saw the average capital raised per fund totaled $491.0M (-26% in value compared to Q4’s $660.1M); this is down significantly from Q1 2022’s top where the average fund raise was $1.1B (-56% in value).

Transaction Bundle – New Paid Report Format!

As mentioned in Q4 2023, DDM continues improve our dataset, reports, and tailored offerings so customers can level up their businesses from our expertise. Taking customer feedback to heart, DDM has decided to streamline to a free Executive Summary report and update our paid report to a Transaction Bundle, allowing customers to have the full listing of investments, M&As, and IPOs from the quarter in a PDF and Excel file format. For those who loved the additional content we provided in each report (developers, blockchain, and each individual segments), fear not, we will still be releasing all of that content throughout the year. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.

Read more in our Q1 2024 Games Investment Review Executive Summary or purchase the standalone single report and transaction bundle for $399. Additional data charts and tables from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com.