2023’s $81.1B Investments/M&As/IPOs Achieves an Unprecedented Record-Shattering Year and Quarter

Microsoft’s $68.7B Acquisition of Activision Blizzard Represents 85% and 97% of the Year’s/Quarter’s Value; Camouflaging Drop in Total Investments and M&As

For the last two years, the games industry navigated macroeconomic headwinds, slower economic growth, a crypto and now eSports winter. Post COVID boom, companies are restructuring their operations through closures, layoffs, and divestitures. 2023 was a historic year for games investments and M&As breaking 2021’s previous record of $74.8B across 1,250 transactions thanks to Microsoft’s colossal $68.7B acquisition of Activision Blizzard that represented 85% of the year’s total of $81.1B across investments and M&As.

However, beneath these shiny totals, the industry struggled to maintain the incredible momentum it achieved during the pandemic and displayed pullback to pre-pandemic growth. For instance, without Microsoft’s $68.7B acquisition, 2023 would have totaled $11.4B across 643 investments and M&As (-85% in value and -45% in volume from 2021’s top of $74.8B across 1,250 in investments and M&As), still significantly higher compared to 2019’s 529 transactions (+22% in volume across investments and M&As).

As we head into 2024 with slower growth, DDM believes that the games industry will struggle to find its footing throughout 2024. Gaming companies will continue to downsize and focus on core products and services bringing many closures, layoffs, restructuring programs, and divestitures to levels not seen previously. However, as macroeconomic headwinds ease in conjunction with a need to deploy dry capital held by venture capital and gaming funds, deep pockets of Saudi Arabia, the need for publishers to shore up their 2026+ release schedules, the continued strength of consumer spending on games plus traction from blockchain games sparked by Bitcoin ETF approval, these factors could help the games industry stabilize heading into 2025.

Investments

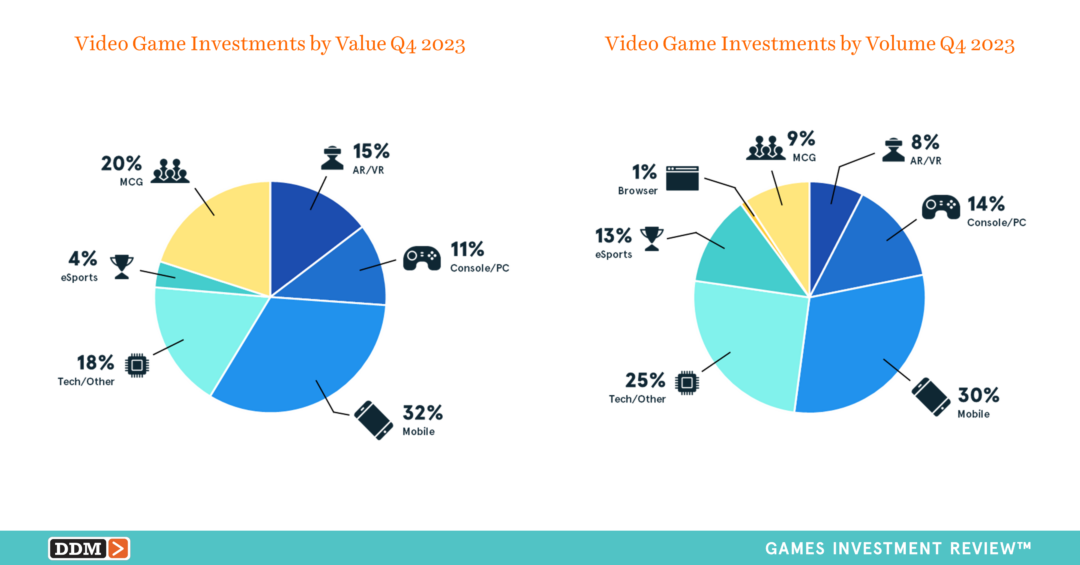

2023 investments totaled $4.4B across 616 investments (-69% in value and -35% in volume over 2022’s $14.0B over 951 investments); while investment values have not been this low since 2016’s $2.4B across 218 investments, it’s worth noting that 2023 volume still performed better than the 2020 pandemic at 500 investments. Q4 2023 investments totaled $936.6M across 119 investments (-22% in value and -21% in volume compared to Q3’s $1.2B and 151 investments), marking the first quarter to achieve a value under $1.0B in investments since Q3 2018’s $641.5M across 76 investments.

M&As

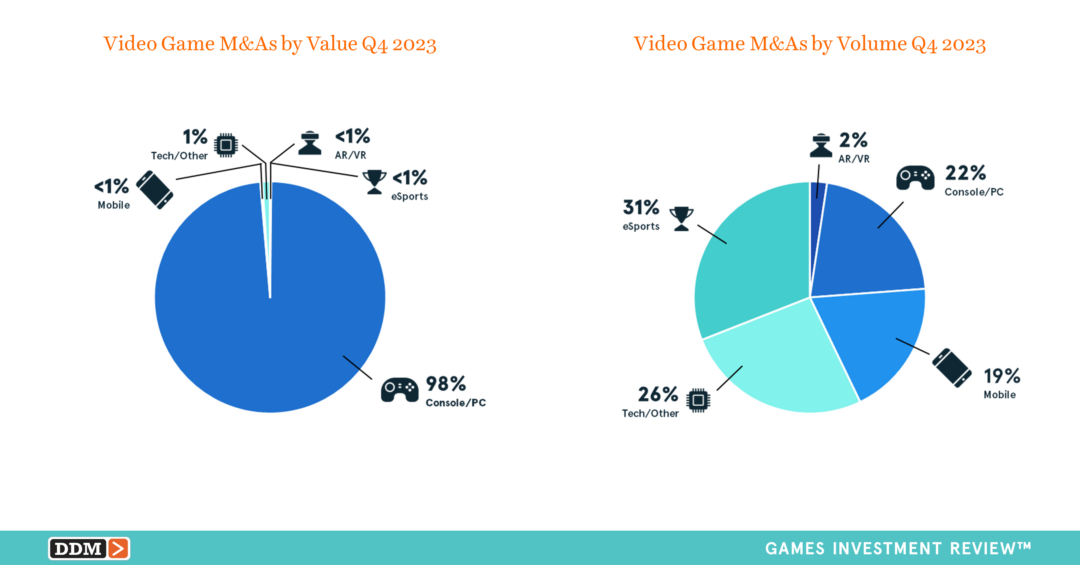

2023 M&As totaled $76.7B across 147 transactions (+85% in value and -50% in volume compared to 2022’s $41.4B across 295 transactions); this 1.9x increase in value was due to Microsoft’s blockbuster $68.7B acquisition of Activision Blizzard which accounted for 90% of the year’s M&A value and exceeded 2022’s record year by over $35.4B and is the single largest transaction in video games history which pushed 2023 to be greater than the last two years of M&As combined. Due to this acquistion, Q4 2023 M&As totaled $69.9B across 42 transactions (+1037% in value and a +36% in volume compared to Q3’s $6.1B across 31 transactions).

New Fund Announcements

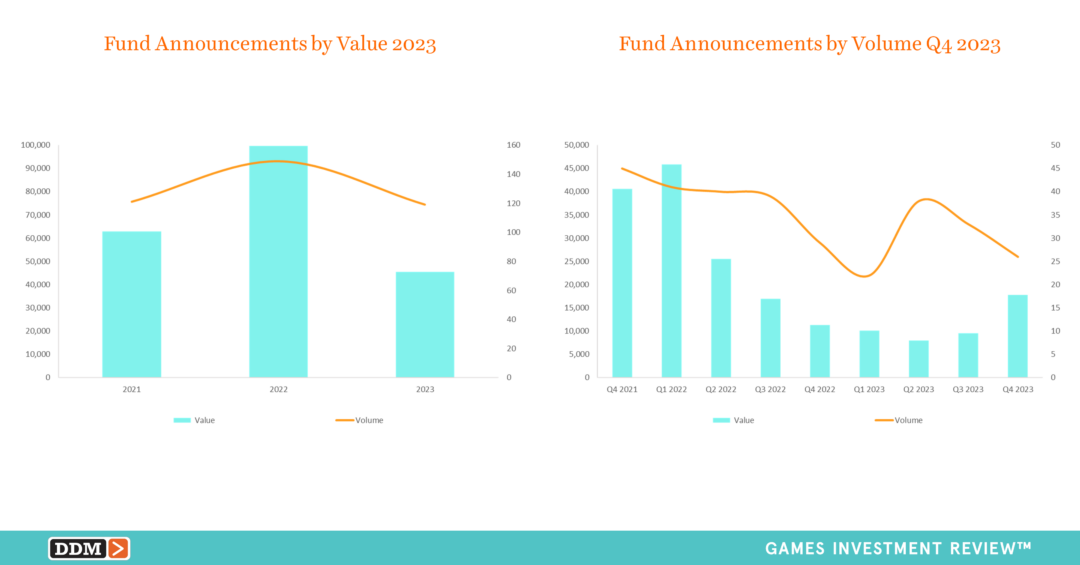

2023 new fund announcements totaled $45.4B in new capital raised across 119 (-54% in value and -20% in volume compared to 2022 totaling $99.6B across 149 funds), the least amount that has been raised the past three years. Q4 2023 fund announcements totaled $17.8B across 26 funds (+87% in value and -21% in volume compared to Q3’s $9.5B across 33 new funds) which is the highest amount of capital raised in over a year going back to Q3 2022’s $16.9B across 40 funds. In prior quarters DDM mentioned that although fund announcements remain high, the amount raised has been at a fraction; however, Q4 saw the average capital raised per fund reach $789.2M (+179% increase in value compared to Q3’s $283.1M) suggesting it’s becoming easier for fund managers to raise capital.

2023 Highlights

In 2023, the M&A news was indicative of what’s been going on in the broader video game industry. As DDM advises clients on investments, M&As, and consults throughout a studio’s life cycle, we see many shifts in the market. Here are some of the top highlights through an investment/M&A lens that our industry navigated throughout 2023 with details in the Executive Summary:

- Microsoft’s $68.7B acquisition of Activision Blizzard showed no company is too large for acquisition

- Saudi Arabia’s impact on the gaming industry is just beginning

- Embracer Group is so large, its actions cause a ripple effect

- China’s pullback will be long-lasting

- eSports is having its own winter

- 2023 shook out FOMO and short-term players within blockchain

- Artificial Intelligence is the latest shiny thing

- Poland continues to be the global gaming IPO hub

- African companies receive interest from foreign investors and acquirers

- Australia wants to rival Canada and UK in growing their games industry

- Game studios who develop user-generated content or develop experiences within Fortnite, Minecraft, and Roblox continue to receive interest from investors

Executive Summary – New Free Report Format!

Since the inception of the Games Investment Review, DDM strives to continuously improve our dataset and reports so our clients can level up their businesses from our insight. In Q3 2023, DDM conducted a survey and found that our clients wanted an easier-to-digest summary of the report. Taking their feedback to heart, DDM has decided to update our free report to the Executive Summary and release additional content that we still gather and analyze throughout the quarter. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.

Read more in our Q4 2023 Games Investment Executive Summary or purchase the standalone single report for $399. Additional data charts and tables from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com.

We always welcome your feedback at data@ddmagents.com