Q1’s $7.8B in Investments/M&As Marks Largest Quarter Since 2023

Q1 Investments Achieve 4.7x QoQ Value Growth, Largest Quarter Since Q2 2022

The game industry’s motto for all of last year was ‘survive till 2025.’ As the industry trudged through 2024, we saw positive signs, and with one quarter in the books, it certainly seems that things are trending in the right direction. Q1 2025 not only marks the second consecutive quarter of growth, but it is the largest quarter since Q4 2023, with combined games investments and M&As totaling $7.8B across 245 transactions (+29% in value and +1% in volume compared to Q4’s $6.0B across 243 combined investments and M&As):

Investments

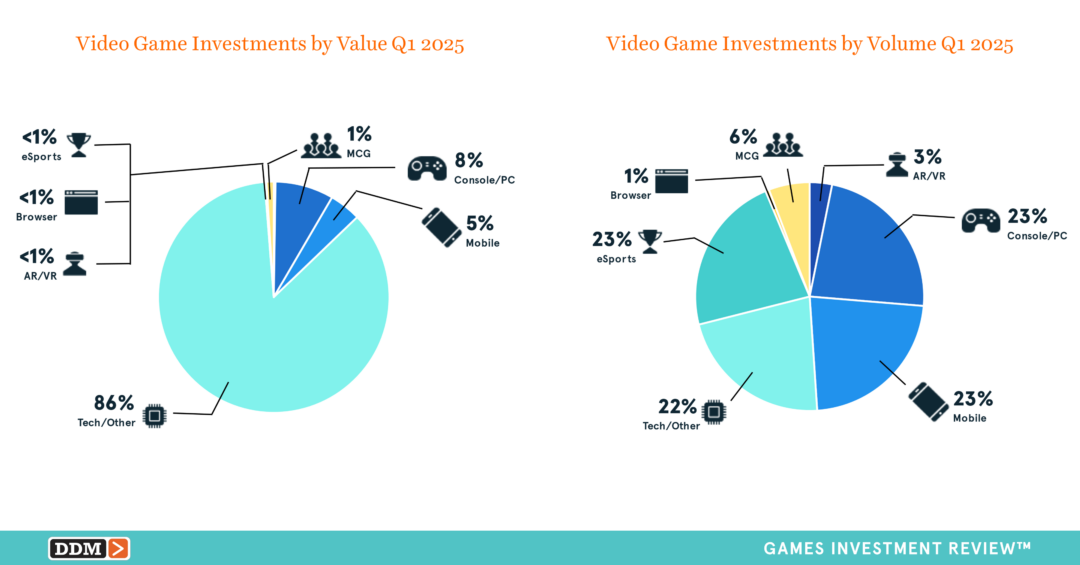

Q1 2025 investments totaled $4.4B across 190 investments (+370% in value and -8% in volume compared to Q4’s $945.9M across 207 investments) achieving a 4.7x in value growth QoQ and the highest value since Q2 2022 of $6.1B. Q1’s achievement can be attributed to Infinite Reality’s $3.0B mid/late-staged investment from Sterling Select (67% of the quarter’s value). Industry segments by value and volume:

M&As

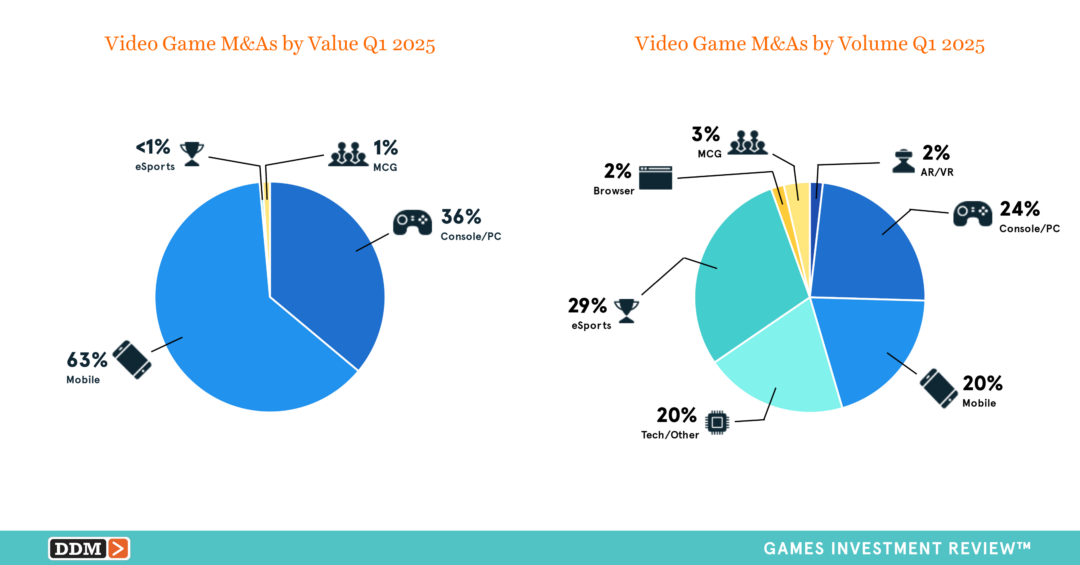

Q1 2025 M&As totaled $3.3B across 55 transactions (-34% in value and +53% in volume compared to Q4’s $5.1BM across 36 transactions) achieving the highest quarterly volume since Q4 2022 of 63 transactions. Q1’s significant decline in reported deal value is due to a high proportion of M&A transactions that did not disclose values (44 out of 55 deals or 80%), which is 13% higher than the historical quarterly average of 67%. Industry segments by value and volume:

New Fund Announcements

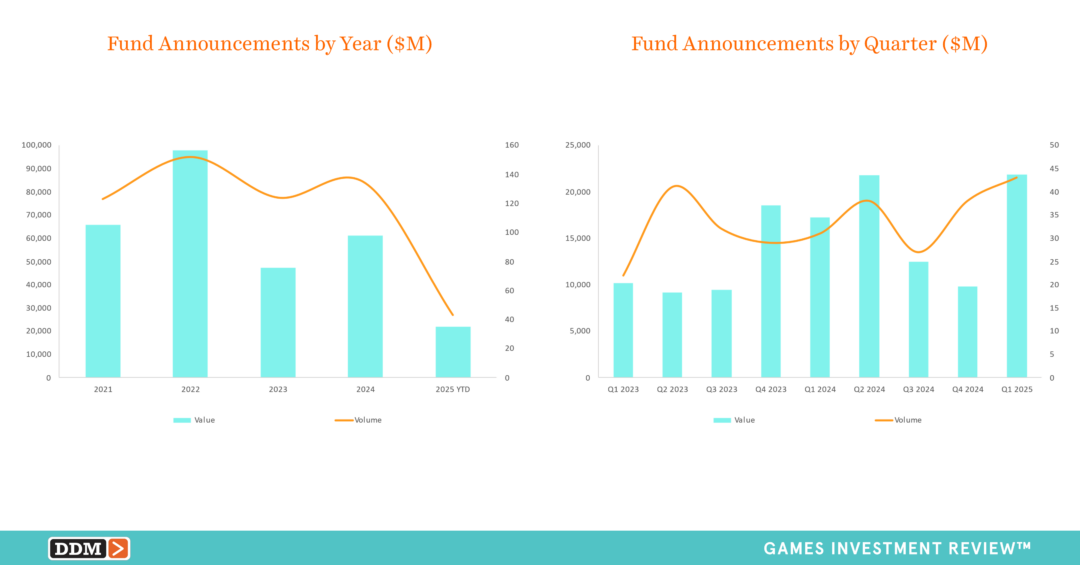

Q1 2025’s new fund announcements totaled $21.8B across 43 funds (+122% in value and +13% in volume compared to Q4’s $9.8B across 38 funds) marking the largest quarter for fund announcements since Q2 2022 of $25.1B across 40 funds. Q1’s 2.2x QoQ value growth was driven by five funds collectively raising over $14.3B (65% of the capital raised): Bank of China ($6.9B), Khosla Ventures ($3.5B), Thoma Bravo ($1.9B), Haun Ventures ($1.0B), and the Government of India ($1.0B). New fund announcements by value and volume:

Read more in our Q1 2025 Games Investment Executive Summary or purchase the Transaction Bundle for $399, which contains the full listing of investments, M&As, and IPOs from the quarter in a PDF and Excel file format. We have greatly expanded the content within developers, Console/PC, and mobile industry segments by releasing individual content drops throughout the year. These drops and additional data charts from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com. We always welcome your feedback at data@ddmagents.com. Follow us at Digital Development Management on LinkedIn for our additional insights or sign up for our newsletter on our website.