Video Game Developers Raised 1.4 Billion in Investments in 2020

2020 alone represented 27 percent of investments raised by developers in the last five years

By Kay Bros with Peggy Twardowski

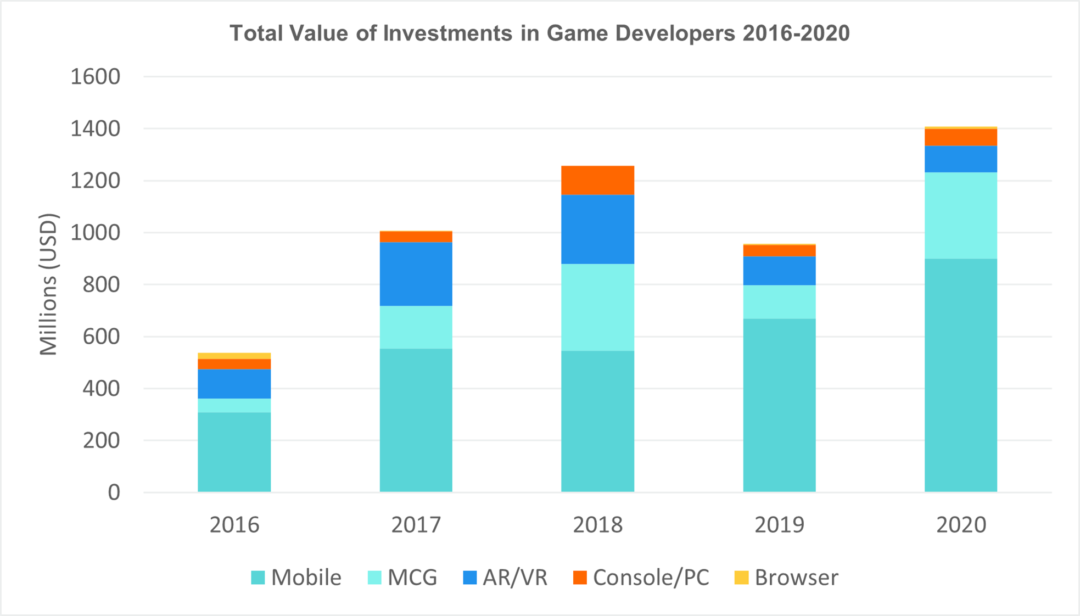

You have heard it a billion times over the past year: 2020 was a record-breaking year for the games industry. Let’s take a closer look at what that means for game developers. Of the $5.6 billion raised over the last five years, we tracked $1.4 billion across 126 investments for 2020 — record-breaking both in value and volume. 2020 represents a 38% increase over 2019’s $957 million in developer investments. The last year that broke 100 investments for developers was 2011.

What do we mean by “developer?” Anyone who makes games on any platform. We did not include hardware developers; middleware developers such as engine, VR creation tools and eSports aim trainers; or other games-related software developers such as community management and chat platforms.

We further restricted our dataset to venture funding stages from Pre-Seed to Series G, excluding crowdfunding, ICO, IPO, post-IPO equity, grants, and accelerators. We focus on Western investments, and these transactions do not include mergers and acquisitions. This report looks at investments per transaction, not per studio, as some studios had multiple funding rounds this year. All funding amounts are given in USD.

We break down these 126 investments with disclosed transaction amounts totaling $1.4 billion by industry segment for 2020, look at the rise in overall value and volume trends and then review the top five investors and top 10 investments for game developers.

Investments by Value

Overall we see a sharp increase in the value of investments raised by game developers, even from the previous record-setting year 2018’s $1.2 billion. This looks especially dramatic right next to 2019’s dip of $957 million.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

The mobile games market has seen steady growth with the rise of affordable smartphones. It has also been the highest category by total value of investments since 2012 across all companies in the video game industry. Mobile game developers in 2020 saw $900.5 million in total investments and made up half of the year’s top 10 transactions.

Mass Community Games/MCG developers saw $331.2 million in investments, largely due to Roblox’s Series G. MCGs made up the other half of the top 10 transactions list.

AR/VR developer investments totaled $103.1 million. This is a downturn from $265.5 million in 2018, the highest total of AR/VR developer investments recorded to date.

Console/PC developers raised $64.9 million in 2020. This is a 40% increase from 2019’s $43.2 million, but not as high as 2018’s $118 million, which included Bungie’s $100 million investment from NetEase.

Browser investments this year came from Sorare’s two Seed rounds, totaling $4.3 million. The French company uses the blockchain for premium fantasy football card trading, a newer trend in blockchain/gaming crossovers.

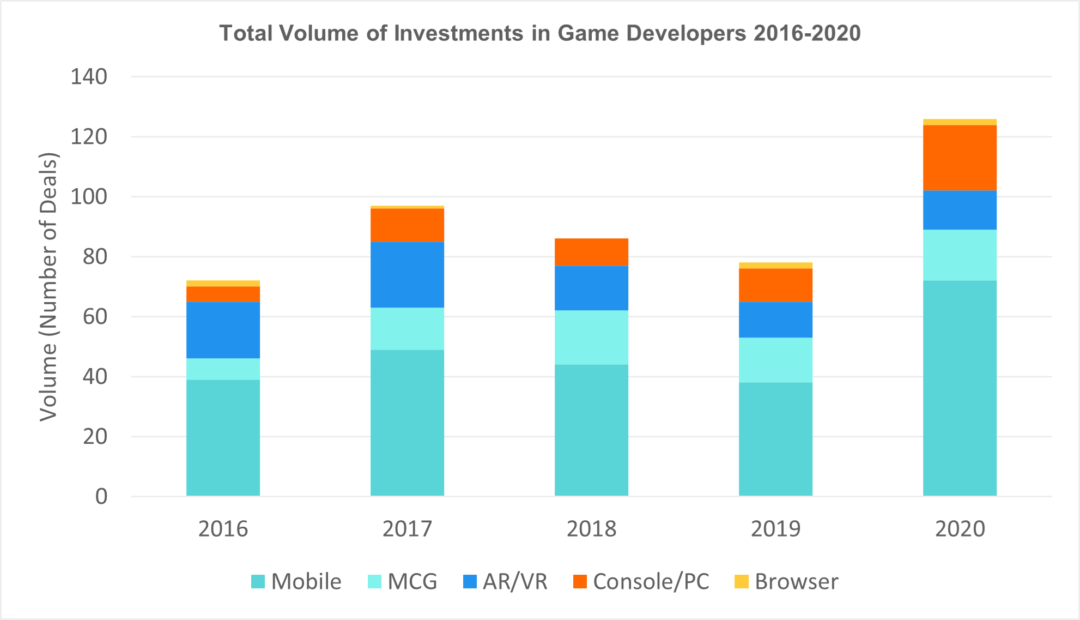

Investments by Volume

We tracked 126 investments with disclosed deal values, a 46% increase over 2019’s 78 investments. The last year that came close to breaking 100 investments for developers with disclosed deal values was 2017, with 97 investments.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

Mobile developers saw 72 investments this year with the largest spread across funding stages, from Pre-Seed to Series E. Not only was this a nearly +47% increase over the next highest year for deal volume achieved in 2017, but for the past five years, no other category has seen more than 22 transactions in a single year.

Mass Community Games/MCG developer investments doubled from seven in 2016 to 16 in 2020. This category has seen renewed interest due to pandemic lockdowns forcing many social interactions online and a renewed interest in the “metaverse,” the concept of a persistent virtual shared space across multiple platforms.

There were 12 AR/VR investments in game developers in 2020. Though the AR/VR games market has not taken off as initially anticipated, volume has held steady at around 12-15 investments per year, clustered around early-stage investments such as Seed and Series A.

We tracked 22 transactions in 2020 for Console/PC developers spread across Seed and Series A investments. With 14 Seed investments this year — more than MCG, Browser, and AR/VR combined — investments in Console/PC developers rarely advance past Series A.

The Browser category has two rounds, Sorare’s Seed rounds. While many games are cross-platform and have a browser presence, especially in the Chinese market, games that exist solely within a browser are becoming rarer.

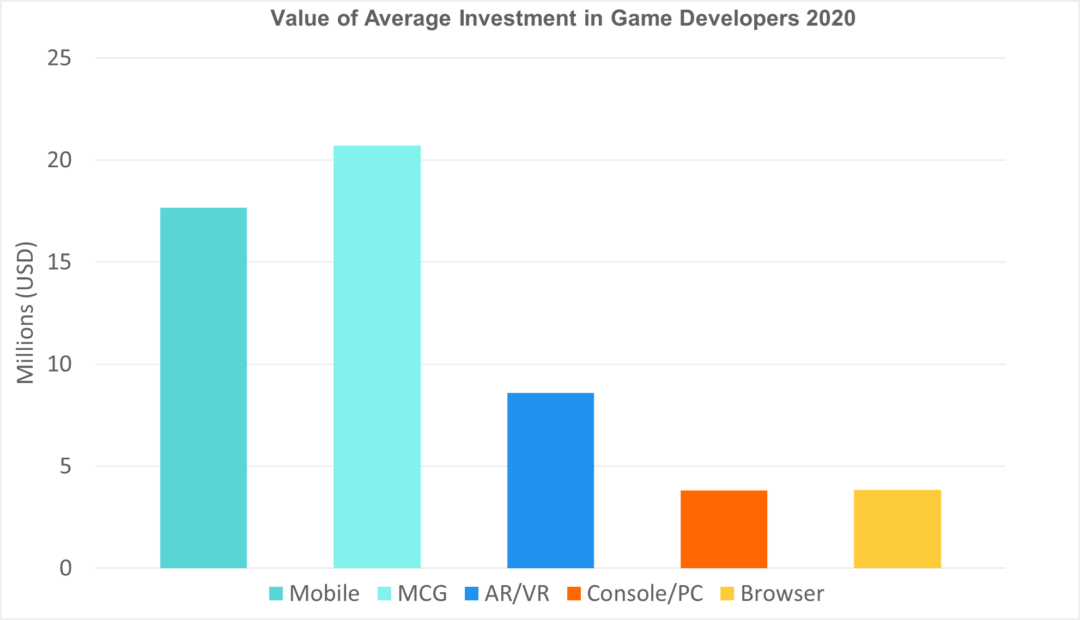

Funding Averages

These averages are calculated from deals with disclosed funding in 2020. For the year, the average investment in development studios per transaction was $14.4 million.

Mobile developers averaged $17.7 million per transaction, the second-highest category for the year.

Mass Community Games/MCG games (battle royale, MOBA, MMO) averaged $20.7 million for the year, the highest category. Excluding notable outlier Roblox’s $150 million Series G, MCG developers averaged $12 million for the year.

AR/VR investments in developers averaged $8.6 million, a slight dip from 2019’s $10.1 million.

Console/PC developers averaged $3.8 million. This is also a dip from 2019’s $4.8 million.

Both Browser investments this year were from Sorare’s two seed Seed rounds. Due to the French fantasy football trading card blockchain developer, the average Browser investment for 2020 was also $3.8 million.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

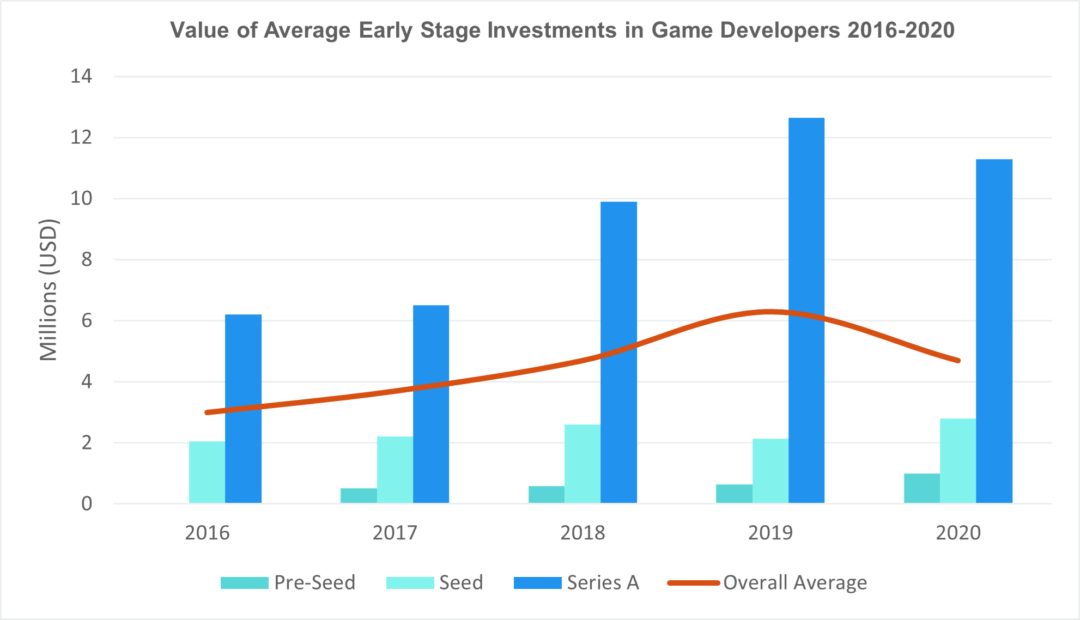

Among funding stages such as Pre-Seed, Seed, and Series A to later-stage funding rounds like Series G in 2020, Seed funding was the most common with a volume of 57 transactions. Series A was the next common funding stage with 20 transactions. Disclosed early-stage investments of Pre-Seed to Series A totaled 84.6% of the year’s volume across 83 transactions.

These average values per transaction looked high; we further investigated, finding record-breaking values of later-stage (Series B or later) investments this year pulling the averages. This is easier to see when broken out by funding stage instead of category.

These following average values by transaction are calculated from deals with disclosed funding. They are averaged over all early-stage or all late-stage investments with disclosed funding for a given year.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

The average early-stage investment in 2020 was $4.7 million, down from 2019’s $5.7 million but the same as 2018’s $4.7 million.

Early-stage investments in development studios have seen steady growth over the past five years, with Pre-Seed rising slightly from $0.5 million to $1 million, Seed also slowly rising from $2 million to just under $3 million, and Series A with the most dramatic rise from $8 million to $11 million (high of $12.6 million in 2019).

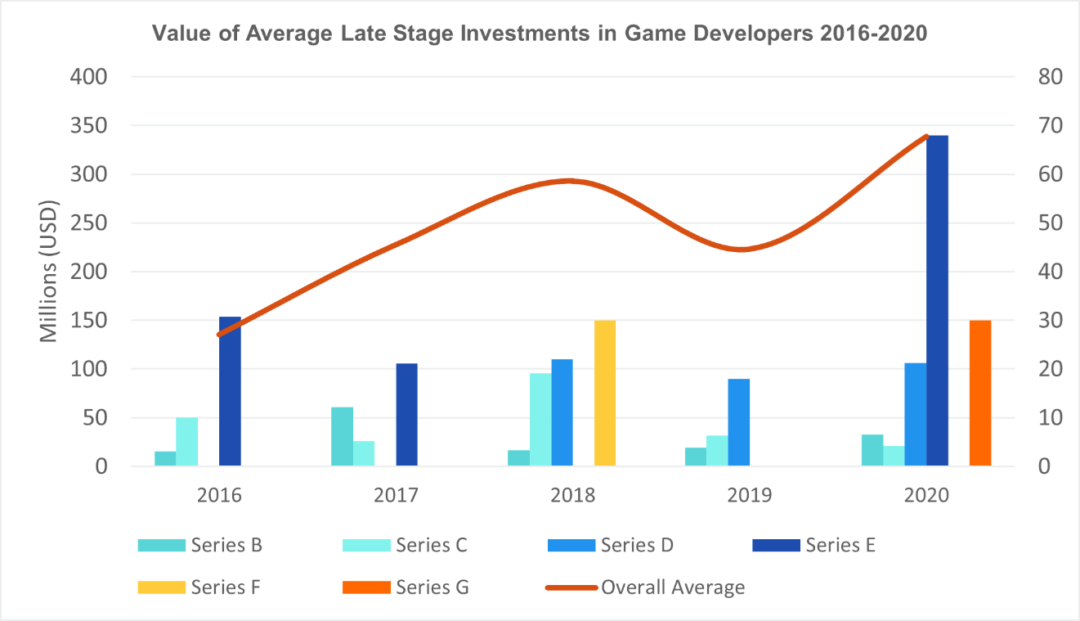

The overall average late-stage investment over all fifteen transactions with disclosed values for 2020 was $67.7 million. Without three large transactions for Roblox and Scopely, the average late-stage investment was $27.1 million. In contrast, 2019’s average late-stage investment was $44.6 million.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

The average late-stage investments are a little more complicated due to a few high-value, high-profile investments. Scopely (Mobile) and Roblox (MCG) together raised $690 million over three rounds this year and are responsible for 13.5% of the year’s entire value. Since there are only one or two funding rounds in Series D, E, and G (no rounds F this year), this skews the average investment value.

Top Investments

Looking back at the top 10 investments of the year for developers reinforces the outlier nature of these late-stage transactions. For example, Wildlife Studios’ $120 million Series B is in keeping with other years’ one or two standout Series B investments among many smaller investments.

While Series C rounds for developers are always noteworthy but not uncommon (we have tracked a total of 58 with disclosed values since 2010), Series D or later rounds are rare. We see an average of two Series D rounds a year. Many years see only one E or F round, or neither. 2020 marks the first time we saw a disclosed Series G round for developers.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

Top Investors

The top five game developer investors are, unsurprisingly, a subset of the top ten investors over all industry segments in 2020. While the categories of developers we excluded (middleware, hardware, eSports) make up a significant portion of the market, as we have shown by the graphs above, there is strong and continued interest in investing directly in studios.

(Source: DDM Games Investment Review)

(Source: DDM Games Investment Review)

“Rounds Total” refers to the total value of all rounds a given investor participated in. Funding targets rarely disclose how much any one company contributed in a round.

“Top Round Value” refers to the highest-value round a given investor participated in. For example, Andreessen Horowitz did not contribute all of Roblox’s $150 million Series G, but it was the lead investor.

“Developer Targets” are studios where a given investor was the lead investor or the highest-valued rounds they participated in.

Conclusion

While both early- and late-stage investments saw a decline in average value by transaction (after removing outliers Roblox and Scopely), the sheer volume of investments was key to this year’s success. Early-stage funding saw 111 transactions, and late-stage saw 15 with disclosed details. All industry segments saw increases except Browser, which held steady at two investments.

We continue to see a steady increase in the average early-stage investment, and larger late-stage rounds are becoming more common. While the outlier effect of multiple high-value late-stage transactions is newsworthy, most developers benefited from the volume of 2020’s Year of Wonders, especially Console/PC developers who rarely see late-stage investments.

All information comes from DDM’s Games Investment Review, an invaluable resource for the games industry, providing detailed, qualified information about investments, mergers and acquisition deals. Maintained and continuously updated, the DDM GIR is the only source of investment, acquisition and merger data specific to the video game industry gathered and rigorously tracked for well over a decade.

The Q4 2020 report, including our annual 2020 review, is available for purchase: $399 per single quarter or $999 for an annual subscription. We will release the Q1 2021 report by the end of April. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.