Q3’s $7.1B Investments/M&As/IPOs Receives a Bump During Industry Shakeout

Q3’s $7.1B Across 166 Transactions is Up 769% in Value From Q2’s $818.4M and 202 Transactions

Looking forward to Q4 2023, 2023 Will Become a Record-Breaking Year Due to Microsoft’s $68.7B Acquisition of Activision Blizzard (closed in October 2023)

By the DDM Data and Research Team

After nearly two full years of enduring macroeconomic headwinds of high inflation and recession fears, an ongoing crypto winter, and slower economic growth, the games industry had a nice bounce after a full-year of declined values.

To refresh memories, the pandemic caused the games industry to see a massive increase in revenues while much of the world was locked in their homes and turned to games to stay occupied. This surge in revenue required studios to focus on game upkeep, hire more employees for future ambitious titles, find funding, and/or look for potential exits as revenues/valuations were at all-time highs. Now as the world returns to normalcy, the audience is no longer locked in doors, causing a backpedal in strong financials. This has resulted in mass layoffs and/or studios tightening their expenses and restructuring operations. The decline in financial stability and transactions for gaming has been quite a lengthy one, but Q3, with its increase of 769% over the previous quarter, has shown a glimpse of hope in still a very shaky time.

Looking forward in Q4 2023, Microsoft officially closed its $68.7B acquisition of Activision Blizzard in October 2023. This transaction is so large it will make 2023 a record-breaking year across investments and M&As in combined value that is greater than the sum of the previous ten M&A quarters which totaled $67.3B. It is worth noting that most company valuations remain dampened and revenues are lower. As a result, 2023 is not a true “reversal” of declines seen from previous quarters.

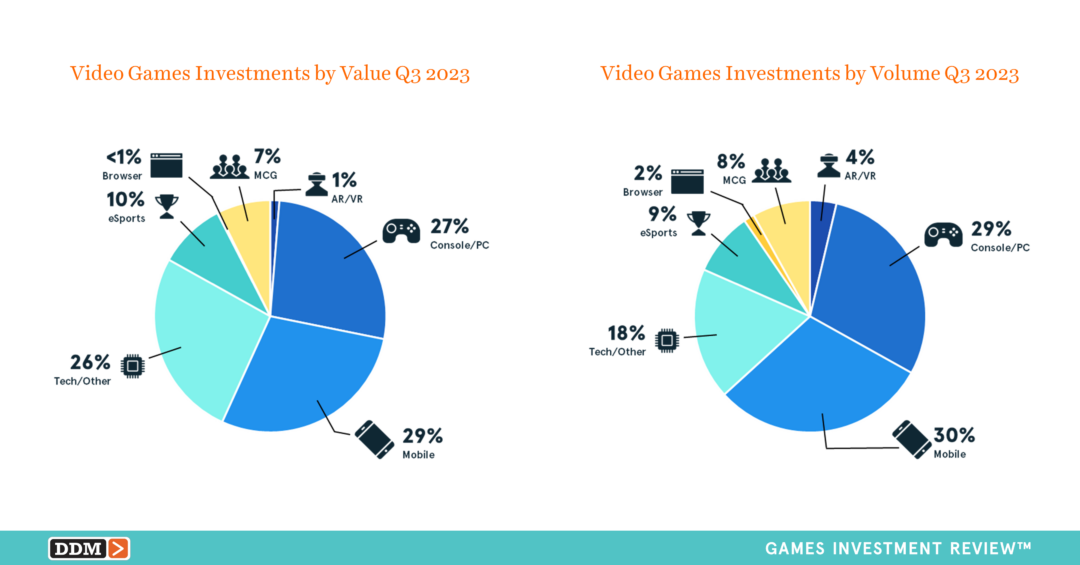

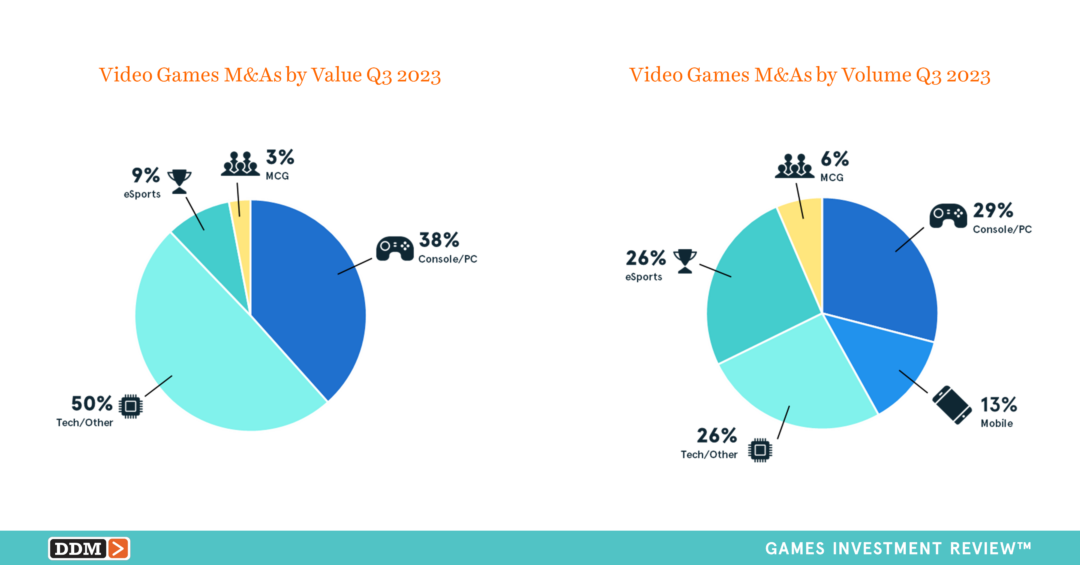

Q3 2023 M&As totaled $6.1B across 30 transactions (+5569% in value and a -9% decrease in volume compared to Q2’s $108.4M across 33 transactions). This 56x increase in value was inflated by the Public Investment Fund of Saudi Arabia’s $4.9B acquisition of Scopely and Sega’s $770.4M acquisition of Rovio (92% of the quarters value) and continued high number of transactions with undisclosed terms.

After over a full year of value decline QoQ, new fund announcements increased in Q3 reaching over $9.4B in new capital raised across 31 funds (+19% in value and -16% in volume compared to Q2’s $7.9B across 37 new funds) propped up from 3 funds raising $1B+ including True Light Capitals $3.3B True Light Fund I. Q3’s bump is still a drastic decline from Q4 of 2021’s top of $45.8B across 41 funds (-79% in value and 24% in value) which further demonstrated market conditions have made it very difficult for fund managers to raise money.

In our report we also highlight big stories that impact the industry including:

- After Closing in Q4, Microsoft + Activision Blizzard Makes 2023 Largest Year on Record For Video Game M&As

- 2023 Will Be a Historical Year For Investments/M&As

- Strategic and Financial Investors/Buyers for More Investments & Acquisitions

- Unity Causes Industry Revolt After Price Restructure

- Most Game Studios Embracing AI While Some Wait for Legal Clarity

- SEC Regulations Continue to Batter Blockchain Games Sentiment

- Gaming and Entertainment Companies Continue to Expand IPs Through Other Mediums

- More Strategics Attracted to India Despite Online Gaming Tax Now Live

Read more in our Q3 2023 Games Investment Review Free Summary or purchase the standalone single report for $399. Additional data charts and tables from our Games Investment Review reports can also be found on our website at DDMGamesInvestmentReview.com.

We’re excited coverage continues from GamesIndustry.biz and Forbes. We recently updated our reports with more data and visualizations and hope you enjoy the free and paid reports. We always welcome your feedback at data@ddmagents.com.