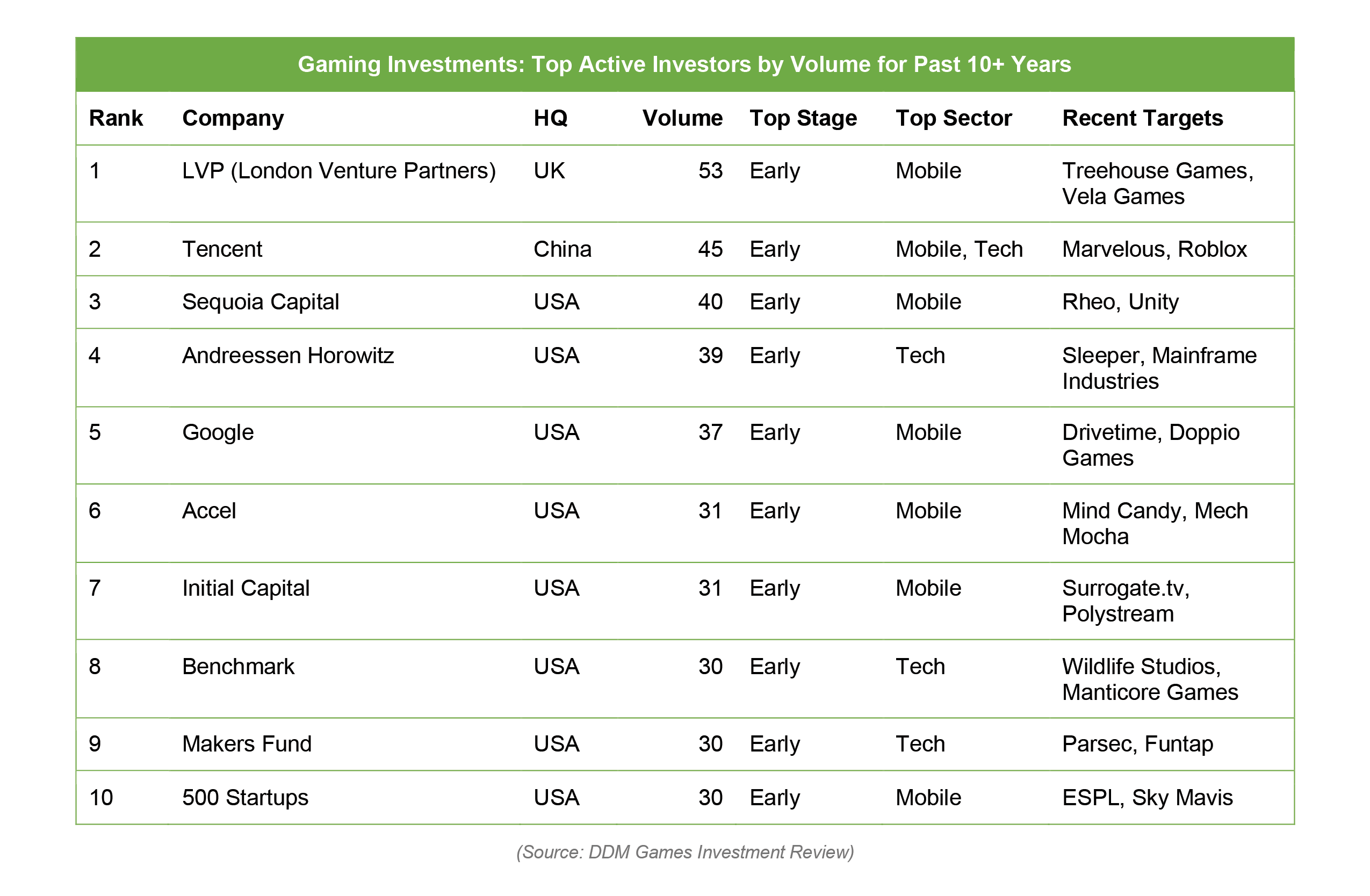

DDM Games Investment Review’s Top Active Investors by Volume in the Gaming Space

It is the second full quarter since we acquired the games investment and M&A data from Digi-Capital. We are busy with data collection, planning our own data strategy and diving through this wonderful trove of data. With this month’s newsletter, we present our first Top 10 List: an overview of the Top 10 Gaming Investors by Deal Volume over the past ten years.

Overall, whether sliced by volume or the amount raised in rounds they participated in, these VC firms are mainly based in the United States and lean heavily into early-stage funding (Series A or earlier) in mobile developers and gaming technology.

Investments by Volume

The Top 10 List is sorted by the number of transactions in which the company participated along with the highest frequency of funding stage and gaming sector. As you will see, firms that favor early-stage investments lend themselves well to doing a higher volume of deals given the lower transaction values. The volume of deals by these companies represents only about 14% of the overall number of tracked investment deals.

A few notes on the list:

- 10+ years of data (2006 to Q2 2020)

- These are investments and not M&A

- Our data focuses on deals done in the West, through the funders themselves may be from anywhere

- Excluded are the 7% of the investments that did not publicly announce the investor(s)

If you have feedback on the types of reports you would like to see, we welcome the input— please drop us a note at data@ddmagents.com.