2022 to be Another Big Year with Q2 Games Investments +37% and M&As Double Q1 2022

Q2 2022 Games Investment Review Report Available

By the DDM Data & Research Team

We witnessed a record year in 2021 where the video games industry achieved unprecedented revenues, investments, and acquisitions. Q1 2022 saw macroeconomic headwinds from the Ukraine war, high interest rates and inflation, and recession concerns which accelerated throughout Q2. Let’s take a closer look at Q2 for the games industry, a global entertainment behemoth said to be recession-resilient and see how things are shaping up.

For investments, Q2 2022 is the highest volume for a second quarter at 217 investments and third highest volume for any quarter on record in our 13+ years of data. It is also the third consecutive quarter where deal volume has exceeded 200 transactions. The value of the disclosed investments for the quarter at $4.8 billion is the third highest for a second quarter and an increase of 37% over Q1’s $3.5 billion. Pushed by Take-Two Interactive’s $12 billion acquisition of mobile giant Zynga, the 59 merger & acquisitions (M&A) totaled $18.6 billion in disclosed deals, more than double Q1’s M&A value of $7.9 billion. At three each for Q1 and Q2, the number of companies having IPOs have returned to pre-pandemic levels while market capitalizations are significantly down as these were all smaller companies.

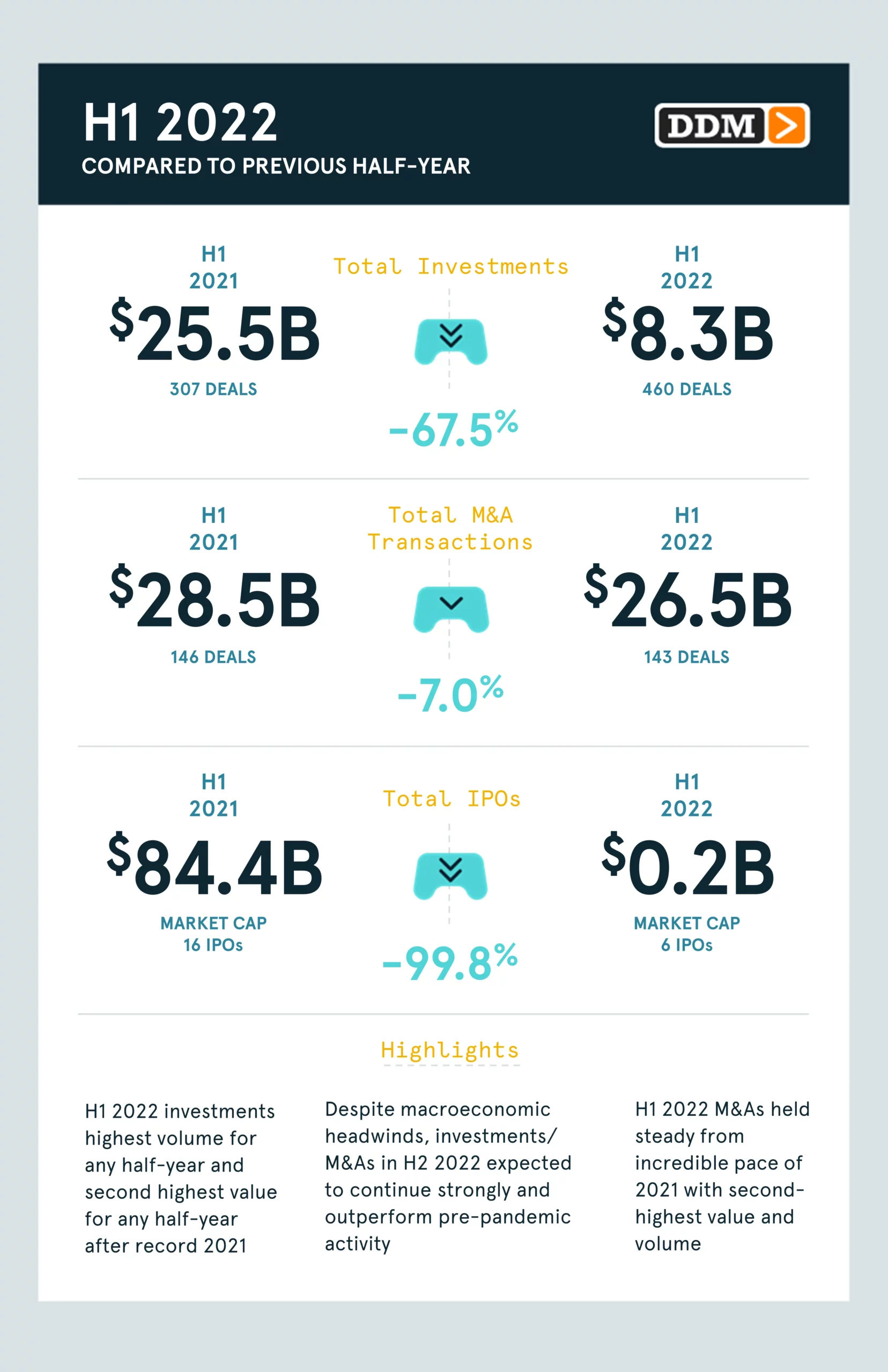

Compared to the first half of 2021, H1 2022 investments are more than halved, M&As are down by a little more than 7%, and IPOs have collapsed. However, the volume of investments is up 33% and M&A have held steady from the incredible pace 2021 set.

As a reminder, 2021 as a whole was the biggest for video games investments and consolidation: 1090 investment and M&A deals, $38.5 billion in investments, and $37.6 billion in M&A disclosed deals. In H1 2021, Roblox, AppLovin, and Playtika had major IPOs raising a combined $16.7 billion at $81.8 billion in market capitalizations. Major acquisitions of Bethesda parent ZeniMax Media by Microsoft, Glu Mobile and Codemasters by Electronic Arts, and Gearbox Software by Embracer Group were collectively worth nearly $12.2 billion. The current half-year is strong compared to previous half-years and for these reasons is positioning 2022 to be another big year for gaming investments and M&As:

- H1 2022 is the highest volume for investments across any half-year

- At over $8.3 billion in investments, it’s the second highest half-year after H1 2021

- Second-highest value and volume for M&As behind 2021’s record-setting year

To continue reading our free Q2 2022 report, click here.

—

The DDM Games Investment Review Q2 2022 report is now available for purchase: $399 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information about our quarterly reports or the DDM Games Investment Review, visit www.ddmgamesinvestmentreview.com or email data@ddmagents.com.

Follow the DDM Games Investment Review on Twitter at @gamesinvestment.